Question: Please read the question carefully and give answer for all parts; Thank , No unprofessonal answer need . Sun Microsystems is a leading supplier of

Please read the question carefully and give answer for all parts; Thank , No unprofessonal answer need .

Sun Microsystems is a leading supplier of computer related products, including servers, workstations, storage devices, and network switches.

In the letter to stockholders as part of the 2021 annual report, President and CEO Scott G. McNealy offered the following remarks. Fiscal 2001 was clearly a mixed bag for Sun, the industry, and the economy as a whole. Still, we finished with revenue growth of 16 percentand thats significant. We believe its a good indication that Sun continued to pull away from the pack and gain market share. For that, we owe a debt of gratitude to our employees worldwide, who aggressively brought costs downeven as they continued to bring exciting new products to market.

The statement would not appear to be telling you enough. For example, McNealy says the year was a mixed bag with revenue growth of 16 percent. But what about earnings? You can delve further by examining the income statement. Also, for additional analysis of other factors, consolidated balance sheet(s) are presented.

Question

On April 20, 2009, the company was valued at US$ 7.4 billion and was acquired by Oracle Corporation. If the company had been sold in the year 2001 what would a good market valuation have been? The book value per share for the years given above were 1998: $1.18; 1999: $1.55; 2000: $2.29; 2001: $3.26.

Base your valuation on the following:

|

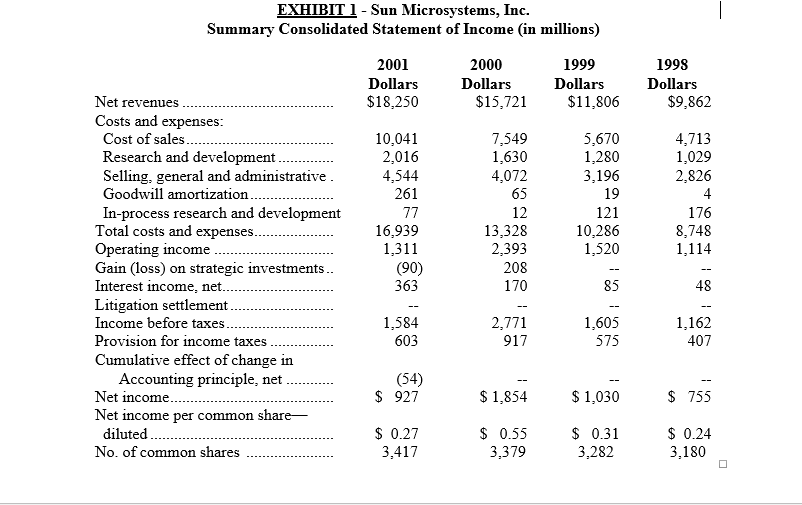

1. Referring to Exhibit 1: a) compute the annual percentage change in net income per common share-diluted (2nd numerical line from the bottom) for 1998-1999, 1999-2000, and 2000-2001. |

| b) compute net incomeet revenue (sales) for each of the four years. Begin with 1998. |

| c) What is the major reason for the change in the answer for question (b) between 2000 and 2001? To answer this question for each of the two years, consider the ratio of the following major income statement accounts to net revenues (sales). Cost of sales Research and development Selling, general and administrative expense Provision for income tax |

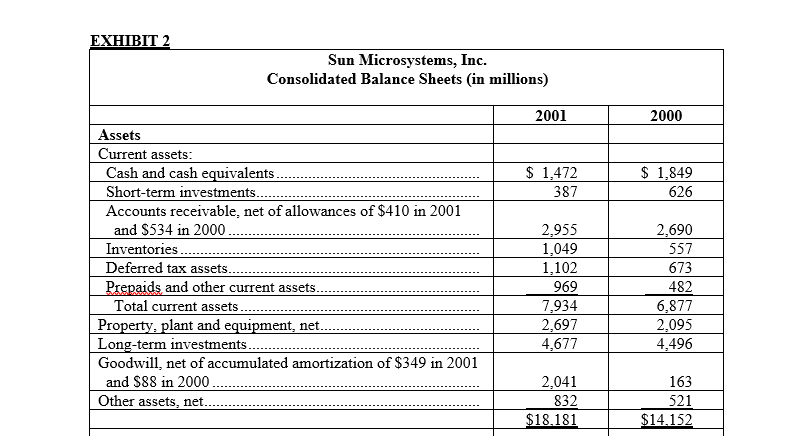

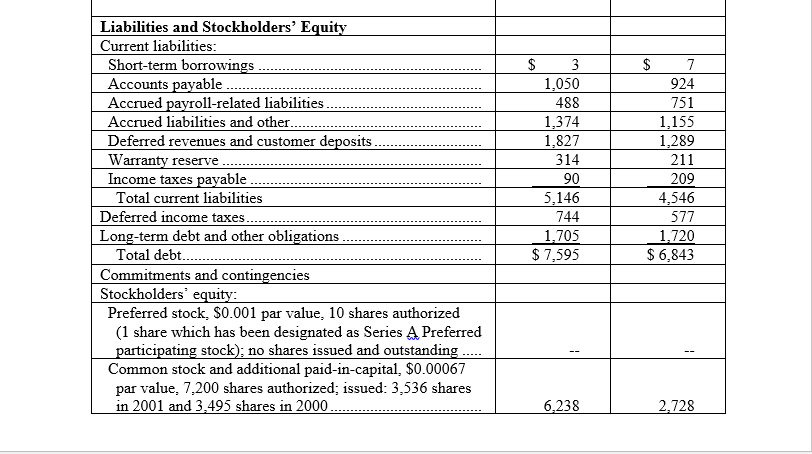

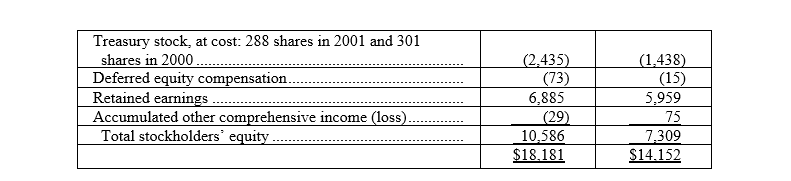

| 2. Referring to Exhibit 1 and 2: a) Compute return on stockholders equity for 2000 and 2001 using data from Exhibits 1 and 2. |

| b) What do you think was the main contributing factor to the change in return on stockholders equity between 2000 and 2001? Think in terms of the Du Pont system of analysis. |

| 3. The average stock prices for each of the four years shown in Exhibit 1 were as follows: 1998: $ 11 ; 1999: 16 ; 2000: 28 ; 2001: 9

|

4. The company paid a dividend of 10% in the year 2000. If the earnings and dividends were to

grow by 20% during the next year, what would be a good valuation of the company? Explain

the reasons for your stated valuation.

5. Class discussion

EXHIBIT 1 - Sun Microsystems, Inc. Summary Consolidated Statement of Income (in millions) 2001 Dollars $18,250 2000 Dollars $15,721 1999 Dollars $11,806 1998 Dollars $9,862 10,041 2,016 4,544 261 77 16,939 1,311 (90) 363 7,549 1,630 4,072 65 12 13,328 2,393 208 5,670 1,280 3,196 19 121 10,286 1,520 4,713 1,029 2,826 4 176 8,748 1,114 Net revenues Costs and expenses: Cost of sales. Research and development. Selling, general and administrative. Goodwill amortization... In-process research and development Total costs and expenses. Operating income Gain (loss) on strategic investments.. Interest income, net. Litigation settlement. Income before taxes... Provision for income taxes Cumulative effect of change in Accounting principle, net Net income... Net income per common share- diluted No. of common shares --- 170 85 48 1,584 603 2,771 917 1,605 575 1,162 407 (54) $ 927 $ 1,854 $ 1,030 $ 755 $ 0.27 3,417 $ 0.55 3,379 $ 0.31 3,282 $ 0.24 3,180 EXHIBIT 2 Sun Microsystems, Inc. Consolidated Balance Sheets (in millions) 2001 2000 $ 1,472 387 $ 1,849 626 Assets Current assets: Cash and cash equivalents.. Short-term investments.. Accounts receivable, net of allowances of $410 in 2001 and $534 in 2000. Inventories. Deferred tax assets. Prepaids and other current assets. Total current assets. Property, plant and equipment, net. Long-term investments. Goodwill, net of accumulated amortization of $349 in 2001 and $88 in 2000 Other assets, net. 2,955 1,049 1,102 969 7,934 2,697 4,677 2,690 557 673 482 6,877 2,095 4,496 2,041 832 $18.181 163 521 $14,152 Liabilities and Stockholders' Equity Current liabilities: Short-term borrowings Accounts payable .... Accrued payroll-related liabilities Accrued liabilities and other.. Deferred revenues and customer deposits. Warranty reserve Income taxes payable Total current liabilities Deferred income taxes. Long-term debt and other obligations. Total debt...... Commitments and contingencies Stockholders' equity: Preferred stock. $0.001 par value, 10 shares authorized (1 share which has been designated as Series A Preferred participating stock), no shares issued and outstanding Common stock and additional paid-in-capital, $0.00067 par value, 7,200 shares authorized; issued: 3,536 shares in 2001 and 3,495 shares in 2000. $ 3 1,050 488 1,374 1,827 314 90 5,146 744 1.705 $ 7,595 $ 7 924 751 1,155 1,289 211 209 4,546 577 1,720 $ 6,843 6,238 2,728 Treasury stock, at cost: 288 shares in 2001 and 301 shares in 2000 Deferred equity compensation. Retained earnings Accumulated other comprehensive income (loss). Total stockholders' equity (2,435) (73) 6,885 (29) 10,586 $18.181 (1,438) (15) 5,959 75 7.309 $14.152 EXHIBIT 1 - Sun Microsystems, Inc. Summary Consolidated Statement of Income (in millions) 2001 Dollars $18,250 2000 Dollars $15,721 1999 Dollars $11,806 1998 Dollars $9,862 10,041 2,016 4,544 261 77 16,939 1,311 (90) 363 7,549 1,630 4,072 65 12 13,328 2,393 208 5,670 1,280 3,196 19 121 10,286 1,520 4,713 1,029 2,826 4 176 8,748 1,114 Net revenues Costs and expenses: Cost of sales. Research and development. Selling, general and administrative. Goodwill amortization... In-process research and development Total costs and expenses. Operating income Gain (loss) on strategic investments.. Interest income, net. Litigation settlement. Income before taxes... Provision for income taxes Cumulative effect of change in Accounting principle, net Net income... Net income per common share- diluted No. of common shares --- 170 85 48 1,584 603 2,771 917 1,605 575 1,162 407 (54) $ 927 $ 1,854 $ 1,030 $ 755 $ 0.27 3,417 $ 0.55 3,379 $ 0.31 3,282 $ 0.24 3,180 EXHIBIT 2 Sun Microsystems, Inc. Consolidated Balance Sheets (in millions) 2001 2000 $ 1,472 387 $ 1,849 626 Assets Current assets: Cash and cash equivalents.. Short-term investments.. Accounts receivable, net of allowances of $410 in 2001 and $534 in 2000. Inventories. Deferred tax assets. Prepaids and other current assets. Total current assets. Property, plant and equipment, net. Long-term investments. Goodwill, net of accumulated amortization of $349 in 2001 and $88 in 2000 Other assets, net. 2,955 1,049 1,102 969 7,934 2,697 4,677 2,690 557 673 482 6,877 2,095 4,496 2,041 832 $18.181 163 521 $14,152 Liabilities and Stockholders' Equity Current liabilities: Short-term borrowings Accounts payable .... Accrued payroll-related liabilities Accrued liabilities and other.. Deferred revenues and customer deposits. Warranty reserve Income taxes payable Total current liabilities Deferred income taxes. Long-term debt and other obligations. Total debt...... Commitments and contingencies Stockholders' equity: Preferred stock. $0.001 par value, 10 shares authorized (1 share which has been designated as Series A Preferred participating stock), no shares issued and outstanding Common stock and additional paid-in-capital, $0.00067 par value, 7,200 shares authorized; issued: 3,536 shares in 2001 and 3,495 shares in 2000. $ 3 1,050 488 1,374 1,827 314 90 5,146 744 1.705 $ 7,595 $ 7 924 751 1,155 1,289 211 209 4,546 577 1,720 $ 6,843 6,238 2,728 Treasury stock, at cost: 288 shares in 2001 and 301 shares in 2000 Deferred equity compensation. Retained earnings Accumulated other comprehensive income (loss). Total stockholders' equity (2,435) (73) 6,885 (29) 10,586 $18.181 (1,438) (15) 5,959 75 7.309 $14.152

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts