Question: Please read the text below and answer all 3 questions.. Below is a picture of an example how it should be answer. Medical Coverage The

Please read the text below and answer all 3 questions.. Below is a picture of an example how it should be answer.

Medical Coverage

The medical plan is a combination of two types of plans-a preferred provider

network and a traditional indemnity plan that does not require a network.

Employees are automatically covered under both and will receive the better preferred

provider organization (PPO) network benefits whenever they use a PPO provider.

Our PPO network offers high-quality care at a discounted price. Benefits provided

under this plan are only for services done by a PPO member. These are referred to as

network providers.

A prescription drug plan is included with the medical plan. All full-time employees

and their eligible dependents qualify for participation in the group dental insurance

program. Coverage for eligible employees is effective after 30 days of employment.

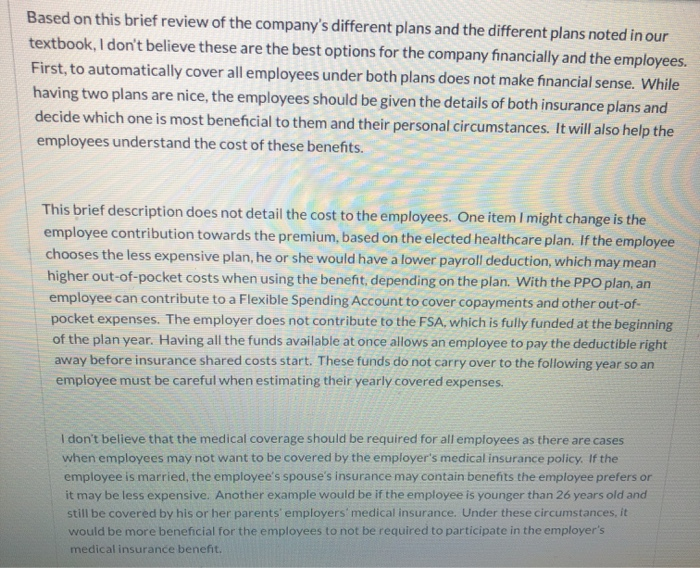

1. are these the best options for the company financially and for the employees to have different options?

2. What do you see that you might do differently to control rising costs in this category?

3. Do you see this as required for all employees, or might there be an option where some employees might just want catastrophic or emergency coverage, or may not need any provided by the company at all?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock