Question: PLEASE refer to data table and requirements for your answer as necessary. PLEASE Right click on image and open image in new tab if text

PLEASE refer to data table and requirements for your answer as necessary.

PLEASE Right click on image and open image in new tab if text is too blurry.

PLEASE type out your answer or use Excel as it is easier to read than handwriting.

PLEASE round all answers as necessary.

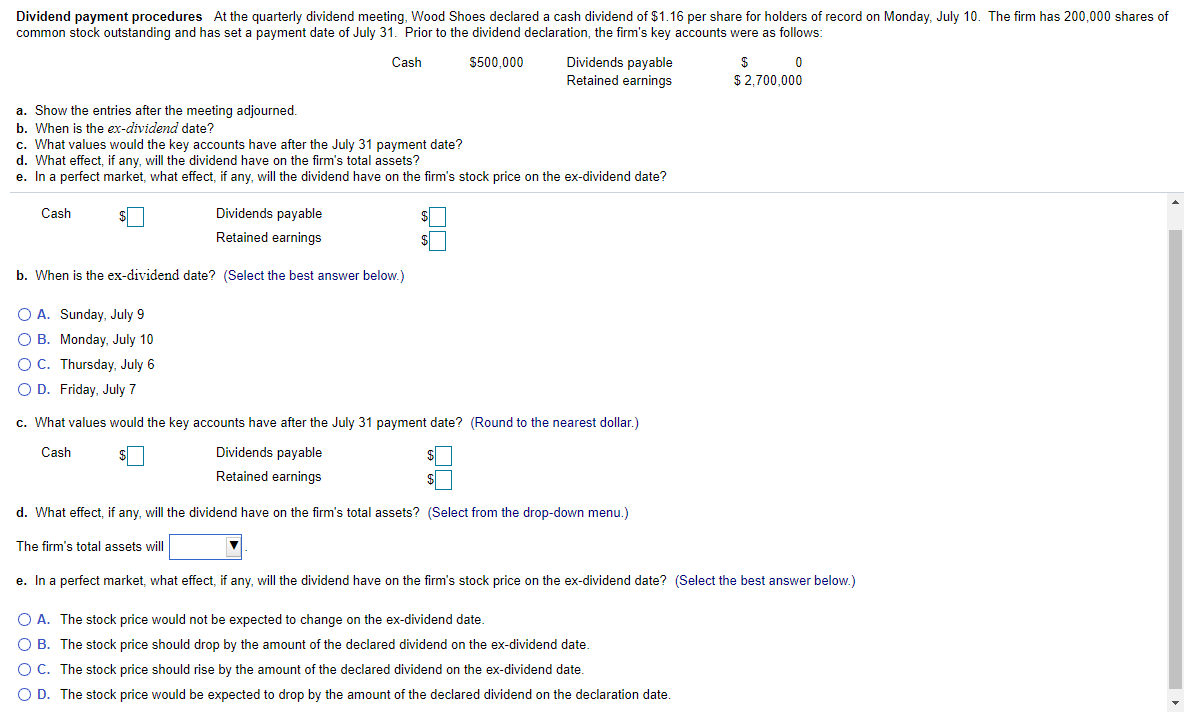

Dividend payment procedures At the quarterly dividend meeting, Wood Shoes declared a cash dividend of $1.16 per share for holders of record on Monday, July 10. The firm has 200,000 shares of common stock outstanding and has set a payment date of July 31. Prior to the dividend declaration, the firm's key accounts were as follows: Cash $500,000 Dividends payable $ 0 Retained earnings $ 2,700,000 a. Show the entries after the meeting adjourned. b. When is the ex-dividend date? c. What values would the key accounts have after the July 31 payment date? d. What effect, if any, will the dividend have on the firm's total assets? e. In a perfect market, what effect, if any, will the dividend have on the firm's stock price on the ex-dividend date? Cash $ Dividends payable Retained earnings b. When is the ex-dividend date? (Select the best answer below.) O A. Sunday, July 9 OB. Monday, July 10 OC. Thursday, July 6 OD. Friday, July 7 c. What values would the key accounts have after the July 31 payment date? (Round to the nearest dollar.) Cash Dividends payable Retained earnings $ d. What effect, if any, will the dividend have on the firm's total assets? (Select from the drop-down menu.) The firm's total assets will e. In a perfect market, what effect, if any, will the dividend have on the firm's stock price on the ex-dividend date? (Select the best answer below.) O A. The stock price would not be expected to change on the ex-dividend date. O B. The stock price should drop by the amount of the declared dividend on the ex-dividend date. OC. The stock price should rise by the amount of the declared dividend on the ex-dividend date. OD. The stock price would be expected to drop by the amount of the declared dividend on the declaration date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts