Question: Please refer to image ---r..--._.-._. --- ---- -u---- .. ... - _._ ----. 1. A company is expected to pay a dividend of $4.50 per

Please refer to image

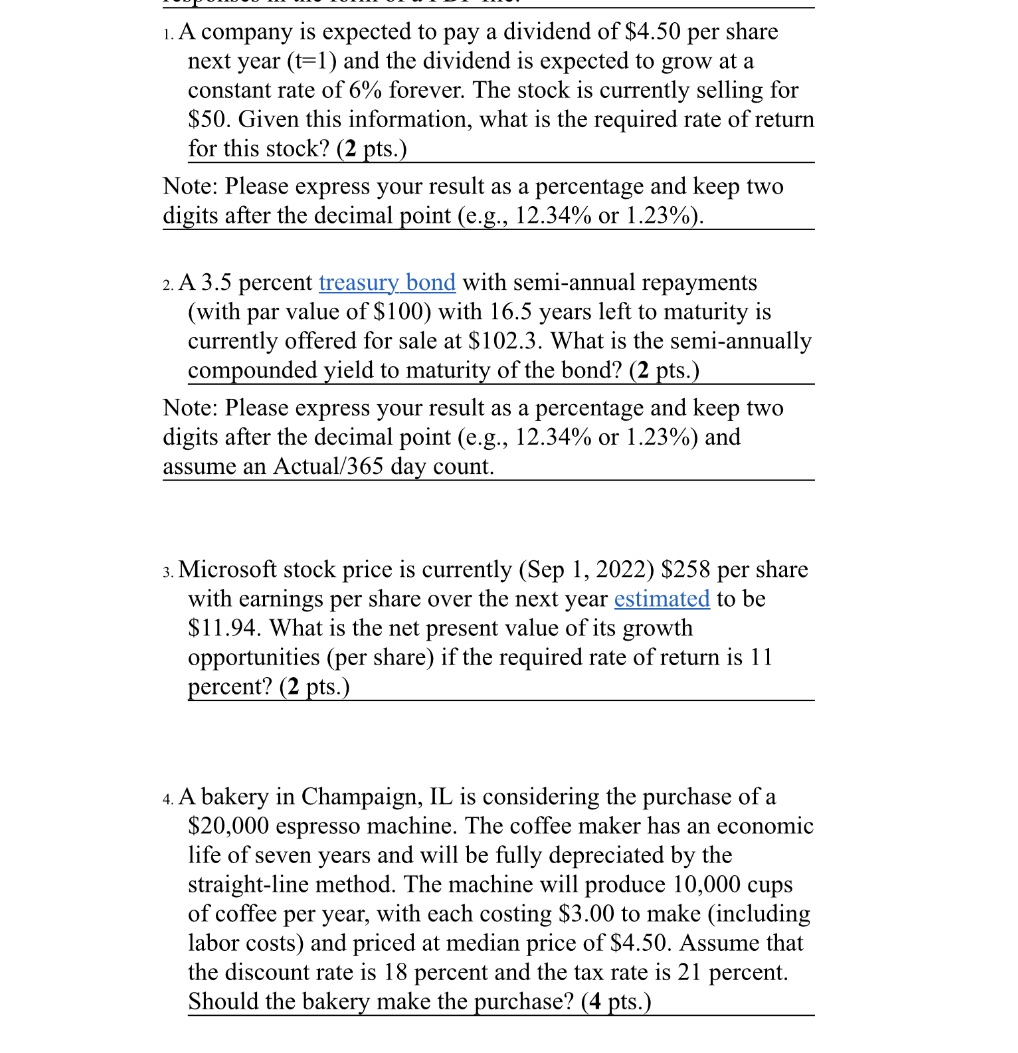

---r..--._.-._. --- ---- -u---- .. ... - _._ ----. 1. A company is expected to pay a dividend of $4.50 per share next year (t=l} and the dividend is expected to grow at a constant rate of 6% forever. The stock is currently selling for $50. Given this information, what is the required rate of return for this stock? (2 pts.) Note: Please express your result as a percentage and keep two digits after the decimal point (cg, 12.34% or 1.23%). 2A 3.5 percent treasury bond with semi-annual repayments (with par value of $100} with 16.5 years left to maturity is currently offered for sale at 3102.3. What is the semi-annually compounded yield to maturity of the bond? {2 pts.) Note: Please express your result as a percentage and keep two digits after the decimal point (e.g., 12.34% or 1.23%) and assume an Actual/365 day count. 3. Microsoft stock price is currently (Sep 1, 2022) $258 per share with earnings per share over the next year estimated to be $11.94. What is the net present value of its growth opportunities (per share) if the required rate of return is 11 percent? (2 pts.) 4. A bakery in Champaign, IL is considering the purchase ofa $20,000 espresso machine. The coffee maker has an economic life of seven years and will be fully depreciated by the straight-line method. The machine will produce 10,000 cups of coffee per year, with each costing $3.00 to make (including labor costs) and priced at median price of $4.50. Assume that the discount rate is 18 percent and the tax rate is 21 percent. Should the bakery make the purchase? (4 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts