Question: i need help with these questions and calculations please Home Project 4 Workbook 2202 Formulas Review View 11 A- A- Wrap Text General Paste Insert

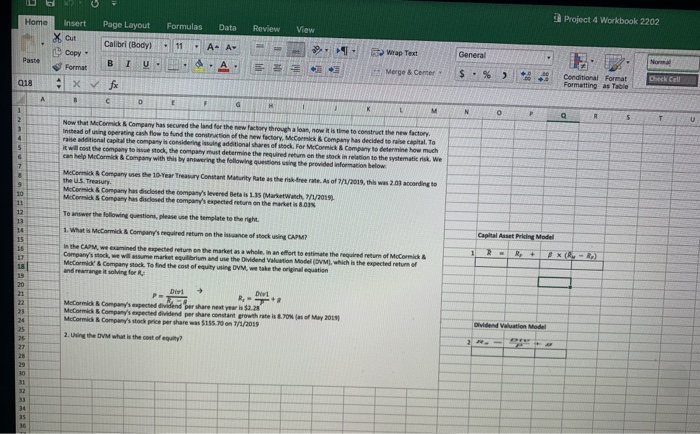

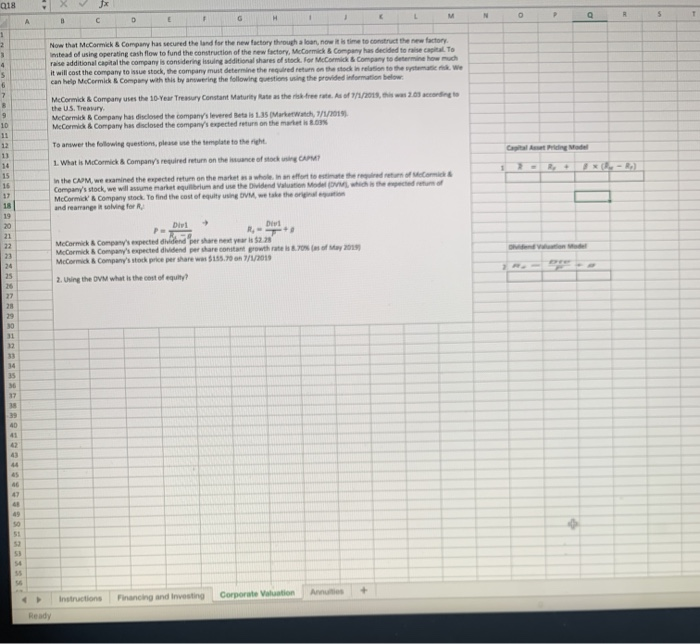

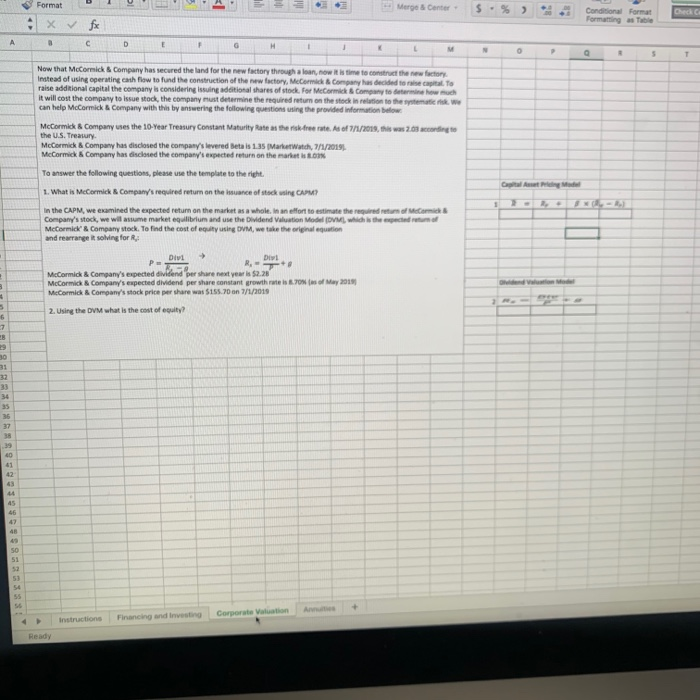

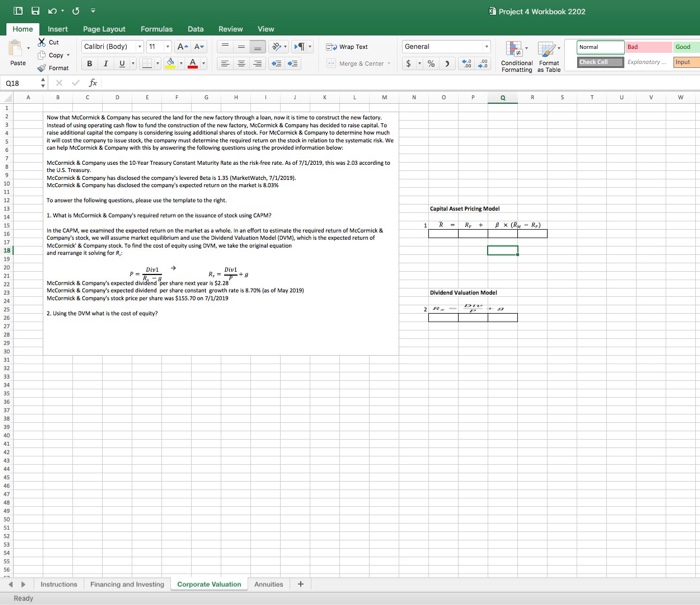

Home Project 4 Workbook 2202 Formulas Review View 11 A- A- Wrap Text General Paste Insert Page Layout x cit Calibri (Body Copy B I U Format Xfx D A. a Merge & Center $ %) . Q18 Conditional Format Formatting as Table Check Cell E F G K M N 0 P Q 5 T 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Now that McCormick & Company has secured the land for the new factory through a loan, now into construct the new factory Instead of using operating cash flow to find the construction of the new factory, Merck & Company has decided to capital. To raise additional capital the company is considering in de tonalres ofted. For eComic Company to determine how much it will cost the company to be stock, the company must determine the required return on the ention to the wewe can help MeCormid & Company with this by answering the following ustions using the provided information below McCormick & Company the 10-Year Teasury Constant Maturity ate as the street. As of 7/1/2018, this was 203 ording to the US Treasury McCormick & Company has disclosed the company's levered Betis 1.3 Marta Watch 7/1/2015 McCormick Company has disclosed the company's expected return on the markets To answer the following questions, please use the template to the right 1. What is McCormick & Company's equired return on the lance of stocking CAM? in the CAPM, we camined the expected return on the market as a whole. In an effort to estimate the required return of McCormick & Company's stock, we will assume market quilibrium and use the Dividend Valuation Model (DM), which is the expected return of MeCormick & Company stock. To find the cost of equity using DVM, we take the original equation and rearrange it solving for Dit Divi P- R. + McCormick & Company's expected dividend pershare next year is $2.28 McCormick & Company's expected dividend per share constant growth rate is 8.ON of May 2011 McCormick & Company's storice per share was $15.70 on 1/1/2019 2. Using the DVM what is the cost of quality Capital Asset Pricing Model 1 R - R + 18 19 20 22 24 25 26 Dividend Valuation Model 29 30 21 33 34 as 36 Pasta Project 4 Workbook 2202 B I U- 018 Gere org B S- . H F Now that is for the new actory wowotection of the new con mi come considering in the forma wed, they dermine the return the and chewing in the vided formation Comascote Trentury Content Matury Rate as the tart. A WhUS Mercedecore levered Betis 1.3 1/1/2018 Com Coche return on the Together 1. What is made the CPM the Atted to them when the reduce commended with the procedure Marcato do they andro 11 13 14 15 1 Dit 23 Ma commend them MC Cm 2. W 27 24 20 1 31 11 14 5 49 54 018 Jx 1 N 5 H o G P B D 1 1 2 1 4 5 6 7 3 10 Catalin Model Now that McCormick & Company has cured the land for the new factory through a loan, now it is time to construct the new factory Instead of using operating cash flow to fund the construction of the new factory, McCormick & Company has decided to raise capital. To raise additional capital the company is considering ing additional shares of stock for McCormick & Company to determine how much it will cost the company to issue stock, the company must determine the required return on these in relation to the woman we can help McCormick & Company with this by answering the following questions using the provided Wormation below McCormick & Company uses the 10-Year Treasury Constant Maturity Rate as the streets of 7/1/2018, this was 2.0 ording to the US Treasury McCormick Company has disclosed the company's levered Betis 1.35 MarketWatch, 7/1/2019 McCormick & Company has disclosed the company's expected return on the market is to To answer the following questions, please use the template to the 1. What is McCormick & Company's required return on the ance of stock using CAM? in the CAM we examined the expected return on the man whole in an effort to estimate the return of comida Company's stock, we will me narkat equilibrium and use the Dividend Valuation Modele the expected to McCormick & Company stock. To find the cost of equity using twee the original and rearrange ting for Divt Dit PE R McCormick & Company's expected dividend per share next year $2.28 McCormick & Company's expected dividend per share constant growth rates of May 2012 McCormick & Company's stock price per share was $15.70 on 7/1/2018 2. Using the DVM what is the cost of equity! 11 14 15 16 17 18 19 20 21 1 22 23 27 28 29 30 31 32 14 36 37 40 46 47 50 53 54 Instructions Financing and Investing Corporate Valuation Ready Merge Center ! $ % ) Format x Conditional Format Formatting Table Check D E F G H 1 M 0 5 T Now that McCormick & Company has secured the land for the new factory through a loan, now it is time to construct the new factory Instead of using operating cash flow to fund the construction of the new factory, McCormick & Company has decided to capital. To raise additional capital the company is considering issuing additional shares of stock for McCormick & Company to determine how much it will cost the company to issue stock, the company must determine the required return on the stock in relation to the systematic can help McCormick & Company with this by answering the following questions using the provided information below. McCormick & Company uses the 10-Year Treasury Constant Maturity Rate as the nick free rott. As of 7/1/2018, this was 2.0 according the U.S. Treasury McCormick & Company has disclosed the company's levered Betis 1.35 MarketWatch, 7/1/2019 McCormick & Company has discused the company's expected return on the market is to To answer the following questions, please use the template to the right 1. What is McCormick & Company's required return on the ance of stock using CAPM? In the CAPM, we examined the expected return on the market as a whole. In an effort to estimate the required return of McComics Company's stock, we will assume market equilibrium and use the Dividend Valuation Model, which is the expected to McCormick & Company stock. To find the cost of equity using DVM, we take the original equation and rearrange it solving for : Divt Di R-7 McCormick & Company's expected dividend per share next year is $2.28 McCormick & Company's expected dividend per share constant growth rate o k. 70m (s of May 2014 McCormick & Company's stock price per share was $15.70 on 7/1/2019 2. Using the DVM what is the cost of equity? 3 11 5 6 30 34 35 36 37 39 40 41 42 65 46 47 48 50 52 Instructions Financing and Investing Corporate Valuation Ready Project 4 Workbook 2202 Home Review View Insert X Out Copy Format Page Layout Formulas Callori (Body). Data A-A- Wap Text General Normal Bad Good Paste BIU Merge & Center $. % Conditional Forma Formatting as Table Check Cell Exploratory Input Q18 A C D E M N P Q R 5 u v w 1 2 3 4 S 6 7 Now that McCormick & Company has secured the land for the new factory through a loan, now it is time to construct the new factory instead of using operating cash flow to fund the construction of the new factory, McCormick & Company has decided to rahe capital. To raise additional capital the company is considering issuing additional shares of stock. For McCormick & Company to determine how much will cost the company to issue stock, the company must determine the required return on the stock in relation to the systematisk. We can help MeCormick & Company with this by adwering the following questions using the provided information below. McCormick & Company uses the 10 Year Treasury Constant Maturity Rute as the riske free rate. As of 7/1/2019 th 2.0 according to McCormick & Company has declared the company's levered Bete lis 1.35 MarketWatch, 7/1/2018). McCormick & Company has declared the company's expected return on the market is 8.02% To answer the following questions, please use the template to the right 1. What is McCormick & Company's required return on the issuance of stock using CAPM? in the CAP, we examined the expected return on the market as a whole, in an effort to estimate the required return of McCormick & Company's stock, we will assume market equilibrium and use the Dividend Valuation Model (DV), which is the expected retum of McCormick & Company stock. To find the cost of equity using DVM, we take the originaletion 10 11 12 13 14 15 36 17 Capital Asset Pricing Modell 29 Divi McCormick & Company's expected dividend per share next year in $2.28 McCormick & Company's expected dividend per share constant growth rate is 8.70 (as of May 2011 McCormick & Company's stock price per share was $15.70 on 7/1/2019 2. Using the VM what is the cost of uit? Dividend Valuation Model 24 26 23 23 30 31 44 45 47 49 50 51 52 53 54 55 Instructions Financing and Investing Corporate Valuation Annuities + Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts