Question: Please refrain from using excel thanks! 2)Suppose the following information reflects a portfolio of stocks Compan Pencil Cornp Eraser Inc Marker Tech Amount Invested $240

Please refrain from using excel thanks!

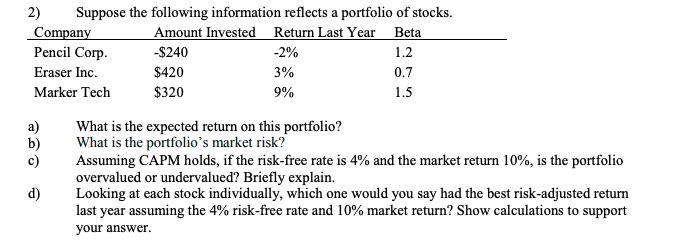

2)Suppose the following information reflects a portfolio of stocks Compan Pencil Cornp Eraser Inc Marker Tech Amount Invested $240 $420 $320 Return Last Year -2% 3% 9% Beta 1.2 0.7 a)What is the expected return on this portfolio? b) What is the portfolio's market risk? Assuming CAPM holds, if the risk-free rate is 4% and the market return 10%, is the portfolio overvalued or undervalued? Briefly explain. d) Loking at each stock individually, which one would you say had the best risk-adjusted return last year assuming the 4% risk-free rate and 10% market return? Show calculations to support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts