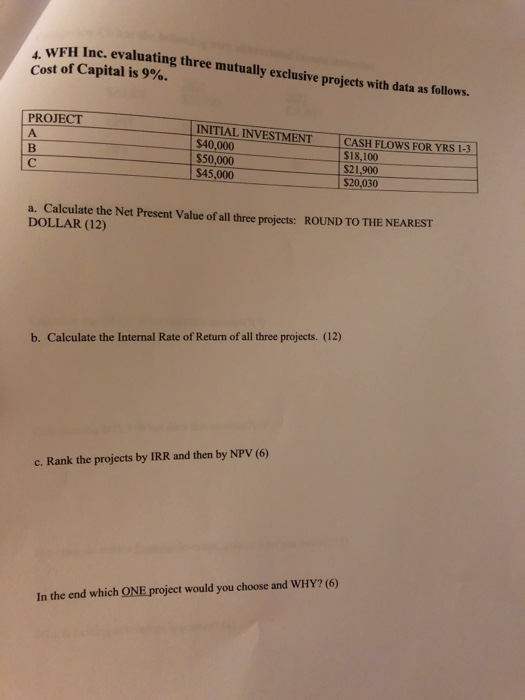

Question: WFH Inc. evaluating three mutually exclusive projects with data as follows. Cost of Capital is 9%. PROJECT CASH FLOWS FOR YRS 1-3 B INITIAL INVESTMENT

WFH Inc. evaluating three mutually exclusive projects with data as follows. Cost of Capital is 9%. PROJECT CASH FLOWS FOR YRS 1-3 B INITIAL INVESTMENT $40,000 $50,000 $45,000 Ic $18,100 $21,900 $20,030 a. Calculate the Net Present Value of all three projects: ROUND TO THE NEAREST DOLLAR (12) b. Calculate the Internal Rate of Return of all three projects. (12) c. Rank the projects by IRR and then by NPV (6) In the end which ONE project would you choose and WHY? (6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts