Question: Please Requesting to answer this question ASAP (attached the appendix if needed) Ms. Tina Oneder is a full-time employee of X Incorporated, an on-line clothing

Please Requesting to answer this question ASAP (attached the appendix if needed)

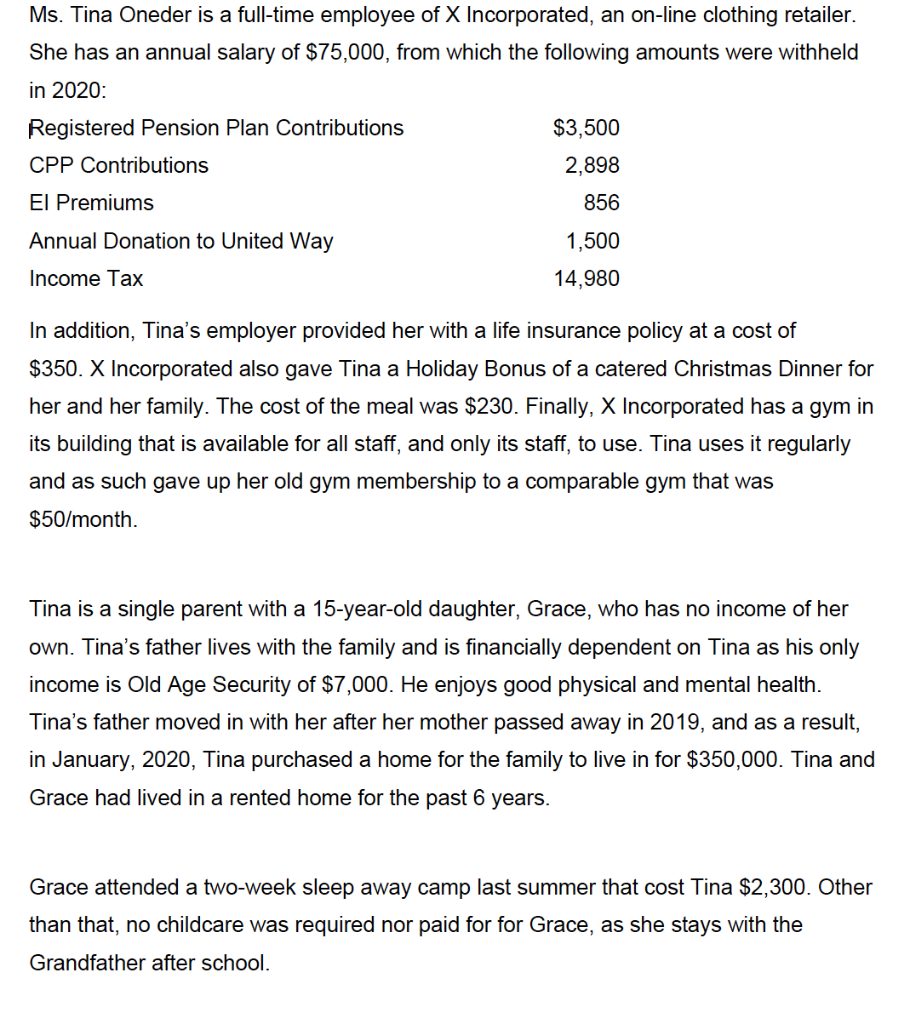

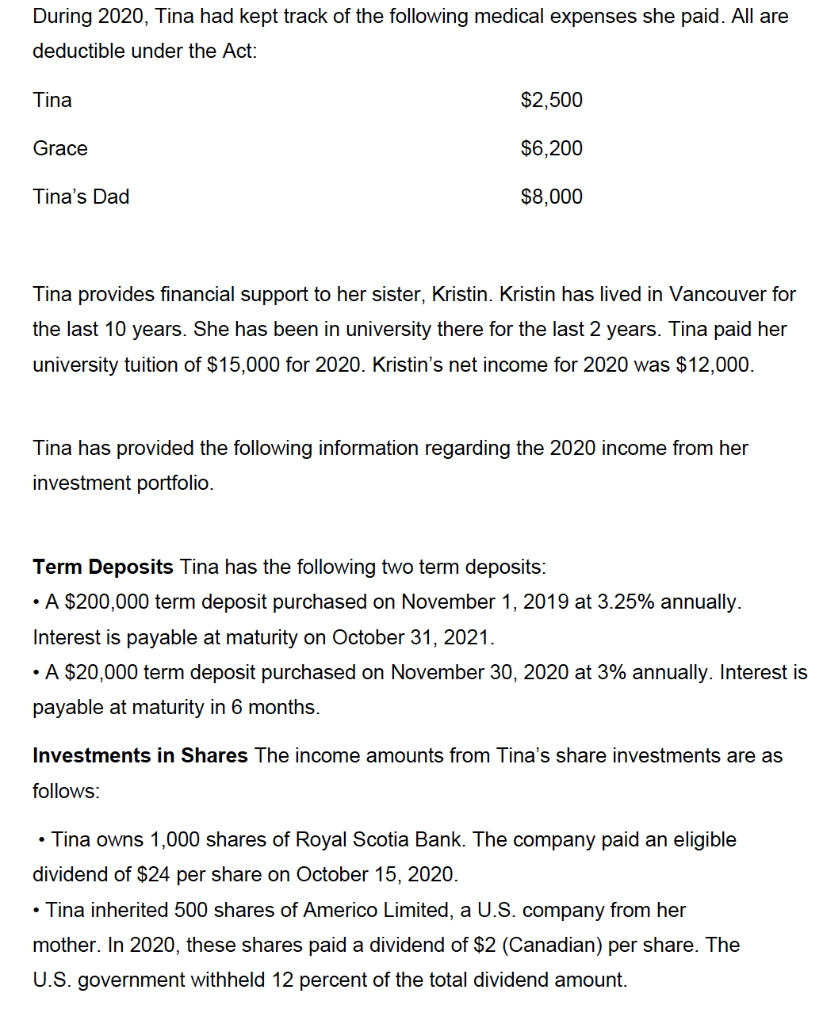

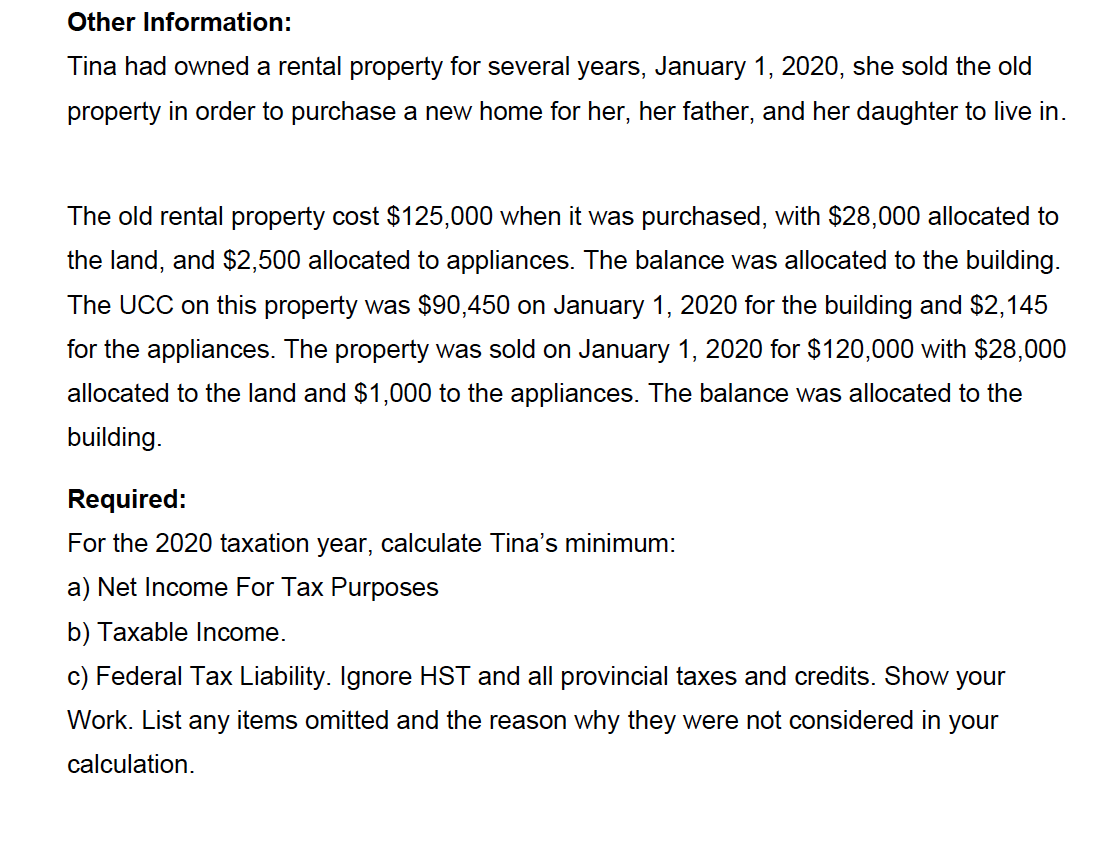

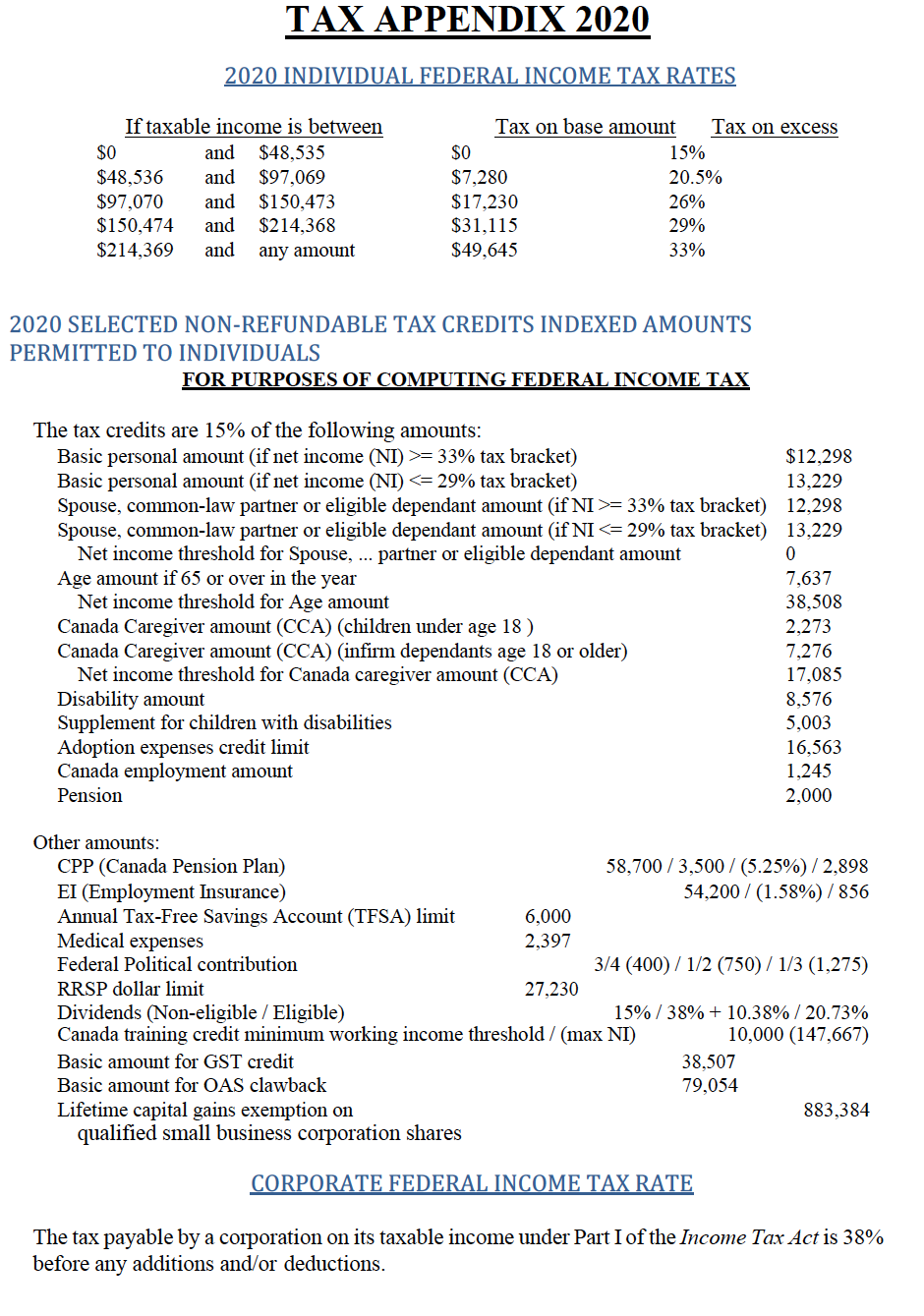

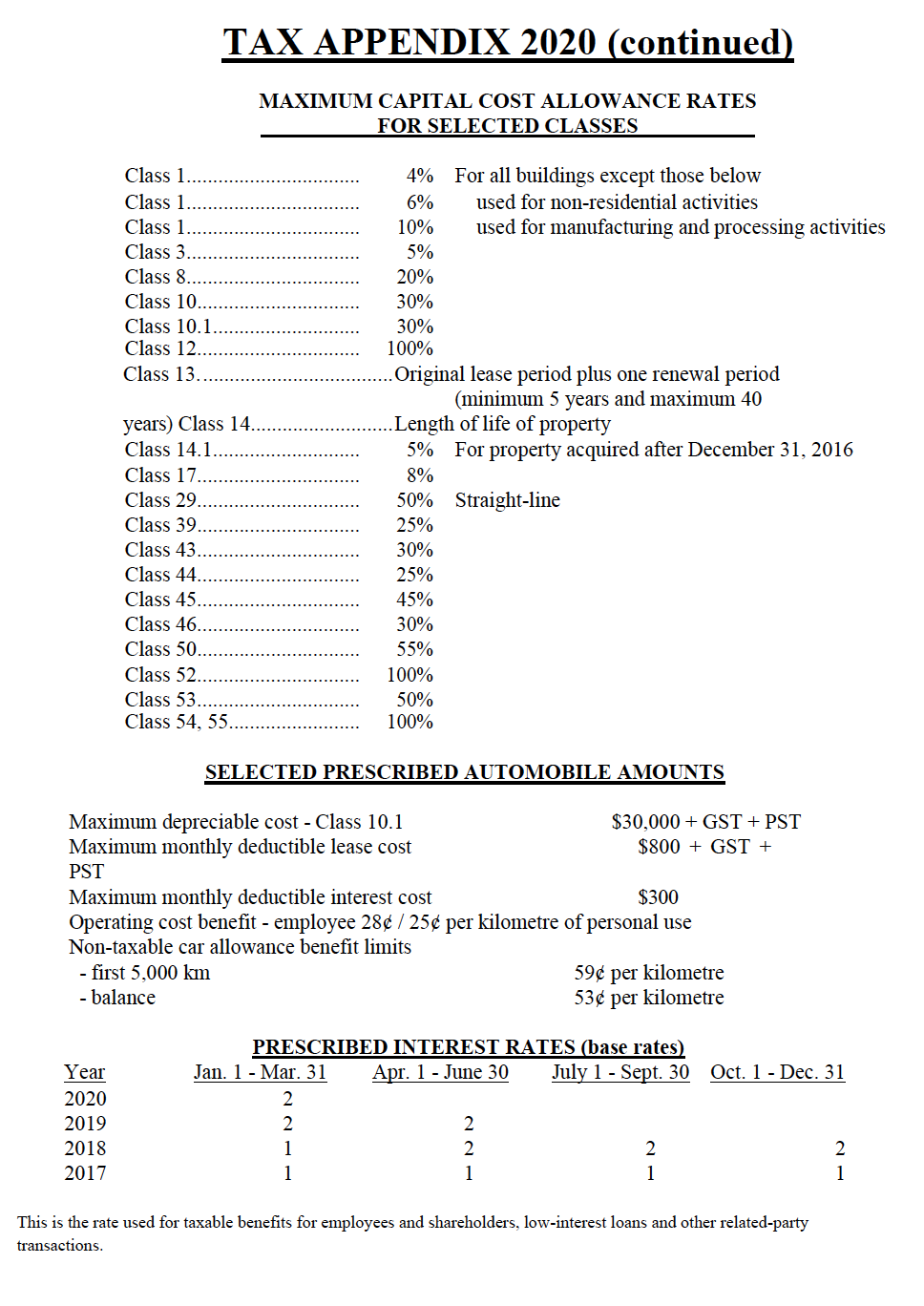

Ms. Tina Oneder is a full-time employee of X Incorporated, an on-line clothing retailer. She has an annual salary of $75,000, from which the following amounts were withheld in 2020: Registered Pension Plan Contributions $3,500 CPP Contributions 2,898 El Premiums 856 Annual Donation to United Way 1,500 Income Tax 14,980 In addition, Tina's employer provided her with a life insurance policy at a cost of $350. X Incorporated also gave Tina a Holiday Bonus of a catered Christmas Dinner for her and her family. The cost of the meal was $230. Finally, X Incorporated has a gym in its building that is available for all staff, and only its staff, to use. Tina uses it regularly and as such gave up her old gym membership to a comparable gym that was $50/month. Tina is a single parent with a 15-year-old daughter, Grace, who has no income of her own. Tina's father lives with the family and is financially dependent on Tina as his only income is Old Age Security of $7,000. He enjoys good physical and mental health. Tina's father moved in with her after her mother passed away in 2019, and as a result, in January, 2020, Tina purchased a home for the family to live in for $350,000. Tina and Grace had lived in a rented home for the past 6 years. Grace attended a two-week sleep away camp last summer that cost Tina $2,300. Other than that, no childcare was required nor paid for for Grace, as she stays with the Grandfather after school. During 2020, Tina had kept track of the following medical expenses she paid. All are deductible under the Act: Tina $2,500 Grace $6,200 Tina's Dad $8,000 Tina provides financial support to her sister, Kristin. Kristin has lived in Vancouver for the last 10 years. She has been in university there for the last 2 years. Tina paid her university tuition of $15,000 for 2020. Kristin's net income for 2020 was $12,000. Tina has provided the following information regarding the 2020 income from her investment portfolio. Term Deposits Tina has the following two term deposits: A $200,000 term deposit purchased on November 1, 2019 at 3.25% annually. Interest is payable at maturity on October 31, 2021. A $20,000 term deposit purchased on November 30, 2020 at 3% annually. Interest is payable at maturity in 6 months. Investments in Shares The income amounts from Tina's share investments are as follows: Tina owns 1,000 shares of Royal Scotia Bank. The company paid an eligible dividend of $24 per share on October 15, 2020. Tina inherited 500 shares of Americo Limited, a U.S. company from her mother. In 2020, these shares paid a dividend of $2 (Canadian) per share. The U.S. government withheld 12 percent of the total dividend amount. Other Information: Tina had owned a rental property for several years, January 1, 2020, she sold the old property in order to purchase a new home for her, her father, and her daughter to live in. The old rental property cost $125,000 when it was purchased, with $28,000 allocated to the land, and $2,500 allocated to appliances. The balance was allocated to the building. The UCC on this property was $90,450 on January 1, 2020 for the building and $2,145 for the appliances. The property was sold on January 1, 2020 for $120,000 with $28,000 allocated to the land and $1,000 to the appliances. The balance was allocated to the building. Required: For the 2020 taxation year, calculate Tina's minimum: a) Net Income For Tax Purposes b) Taxable Income. c) Federal Tax Liability. Ignore HST and all provincial taxes and credits. Show your Work. List any items omitted and the reason why they were not considered in your calculation. TAX APPENDIX 2020 2020 INDIVIDUAL FEDERAL INCOME TAX RATES If taxable income is between $0 and $48,535 $48,536 and $97,069 $97,070 and $150,473 $150,474 and $214,368 $214,369 and any amount Tax on base amount Tax on excess SO 15% $7,280 20.5% $17,230 26% $31,115 29% $49,645 33% 2020 SELECTED NON-REFUNDABLE TAX CREDITS INDEXED AMOUNTS PERMITTED TO INDIVIDUALS FOR PURPOSES OF COMPUTING FEDERAL INCOME TAX The tax credits are 15% of the following amounts: Basic personal amount (if net income (NI) >= 33% tax bracket) $12,298 Basic personal amount (if net income (NI) =33% tax bracket) 12,298 Spouse, common-law partner or eligible dependant amount (if NI = 33% tax bracket) $12,298 Basic personal amount (if net income (NI) =33% tax bracket) 12,298 Spouse, common-law partner or eligible dependant amount (if NI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts