Question: Please resolve example 6 .. please show the calculations Advance Accounting Chapter 14 Partnerships Formation and Operation Example 6: Foreign Currency Option Used to Hedge

Please resolve example 6 .. please show the calculations

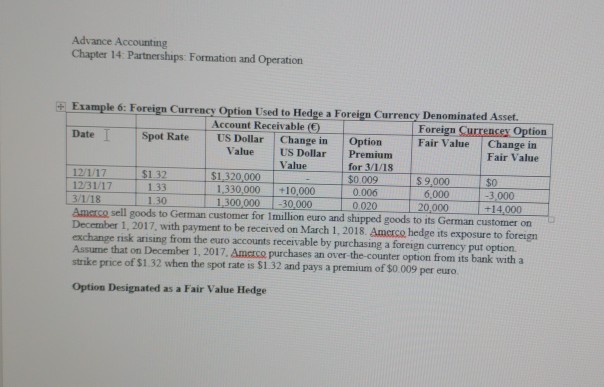

Advance Accounting Chapter 14 Partnerships Formation and Operation Example 6: Foreign Currency Option Used to Hedge a Foreign Currency Denominated As Date Spot RateUS Dollar Change in Option Foreign Surrencex Option Fair Value Change in Account Receivable ( Fair Value Value US Dollar Premium for 3/1/18 Value $1.32 1.33 3/1/181.30 $0 009 0.006 $ 9,000 6.000 20,000 $1,320,000 1.330000 +10,000 1,300,000 -30,000 1231/17 +14,000 Amerco sell goods to German customer for Imillion euro and shapped goods to its German customer on December 1, 2017, with payment to be received on March 1, 2018. Amcrco hedge its exposure to foreign exchange risk arising from the euro accounts receivable by purchasing a foreign currency put optiorn Assume that on December 1, 2017. Ameco purchases an over the-counter option from its bank witha strike price of $1.32 when the spot rate is $1.32 and pays a premium of $0 009 per euro. Option Designated as a Fair Value Hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts