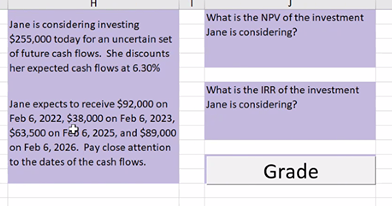

Question: Please Respond with excel with the formula if needed. What is the NPV of the investment Jane is considering? Jane is considering investing $255,000 today

Please Respond with excel with the formula if needed.

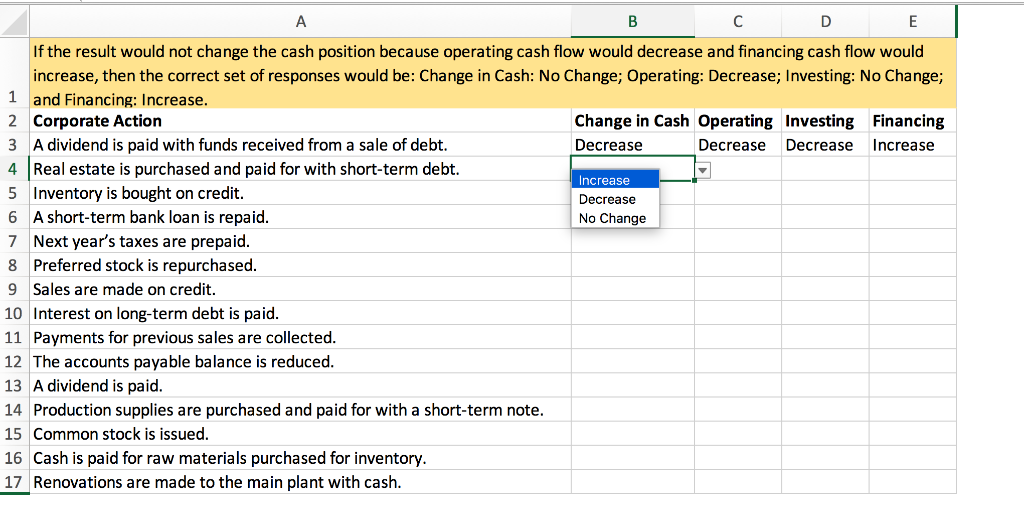

What is the NPV of the investment Jane is considering? Jane is considering investing $255,000 today for an uncertain set of future cash flows. She discounts her expected cash flows at 6.30% What is the IRR of the investment Jane is considering? Jane expects to receive $92,000 on Feb 6, 2022, $38,000 on Feb 6, 2023, $63,500 on Feb 6, 2025, and $89,000 on Feb 6, 2026. Pay close attention to the dates of the cash flows. Grade A B D E If the result would not change the cash position because operating cash flow would decrease and financing cash flow would increase, then the correct set of responses would be: Change in Cash: No Change; Operating: Decrease; Investing: No Change; 1 and Financing: Increase. 2 Corporate Action Change in Cash Operating Investing Financing 3 A dividend is paid with funds received from a sale of debt. Decrease Decrease Decrease increase 4 Real estate is purchased and paid for with short-term debt. Increase 5 Inventory is bought on credit. Decrease 6 A short-term bank loan is repaid. No Change 7 Next year's taxes are prepaid. 8 Preferred stock is repurchased. 9 Sales are made on credit. 10 Interest on long-term debt is paid. 11 Payments for previous sales are collected. 12 The accounts payable balance is reduced. 13 A dividend is paid. 14 Production supplies are purchased and paid for with a short-term note. 15 Common stock is issued. 16 Cash is paid for raw materials purchased for inventory. 17 Renovations are made to the main plant with cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts