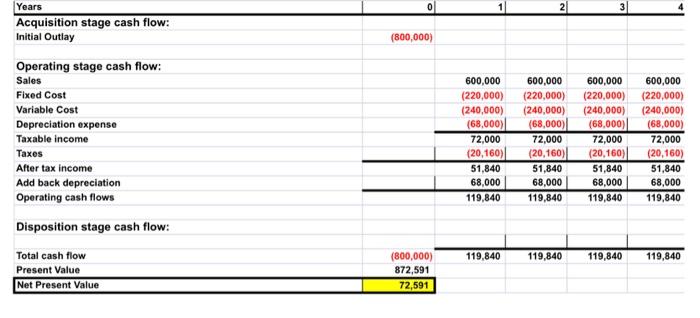

Question: Please run a net present value breakeven using this original data and record the net present value level of sales here ___________. Prior to beginning

2 3 Years Acquisition stage cash flow: Initial Outlay (800,000) Operating stage cash flow: Sales Fixed Cost Variable Cost Depreciation expense Taxable income Taxes After tax income Add back depreciation Operating cash flows 600,000 (220,000) (240,000) (68,000) 72.000 (20,160) 51,840 68,000 119,840 600,000 (220,000) (240,000) (68,000) 72,000 (20,160) 51,840 68,000 119,840 600,000 (220,000) (240,000) (68.000) 72,000 (20,160) 51,840 68,000 119,840 600,000 (220,000) (240,000) (68,000) 72,000 (20,160) 51,840 68,000 119,840 Disposition stage cash flow: 119,840 119,840 119,840 119,840 Total cash flow Present Value Net Present Value (800,000) 872,591 72,591 2 3 Years Acquisition stage cash flow: Initial Outlay (800,000) Operating stage cash flow: Sales Fixed Cost Variable Cost Depreciation expense Taxable income Taxes After tax income Add back depreciation Operating cash flows 600,000 (220,000) (240,000) (68,000) 72.000 (20,160) 51,840 68,000 119,840 600,000 (220,000) (240,000) (68,000) 72,000 (20,160) 51,840 68,000 119,840 600,000 (220,000) (240,000) (68.000) 72,000 (20,160) 51,840 68,000 119,840 600,000 (220,000) (240,000) (68,000) 72,000 (20,160) 51,840 68,000 119,840 Disposition stage cash flow: 119,840 119,840 119,840 119,840 Total cash flow Present Value Net Present Value (800,000) 872,591 72,591

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts