Question: Please run the following two binomial models/trees: For a Call, assume: So = $51, X = $50. Assume during each period the stock will either

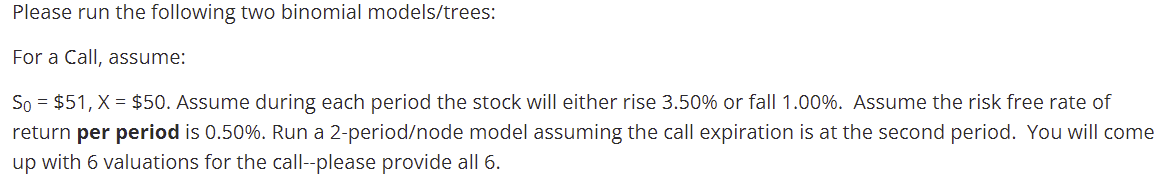

Please run the following two binomial models/trees: For a Call, assume: So = $51, X = $50. Assume during each period the stock will either rise 3.50% or fall 1.00%. Assume the risk free rate of return per period is 0.50%. Run a 2-periodode model assuming the call expiration is at the second period. You will come up with 6 valuations for the call--please provide all 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts