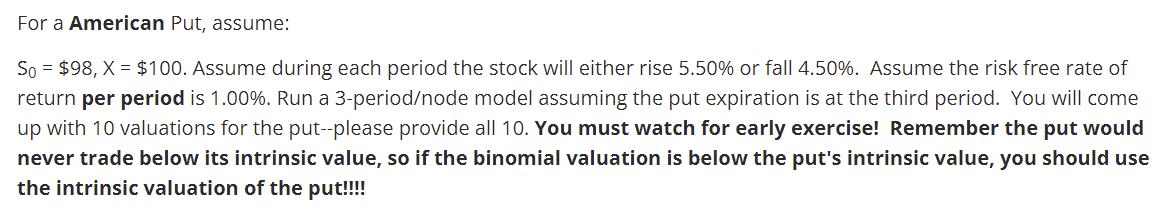

Question: Please run the following two binomial models/trees: For a American Put, assume: a So = $98, X = $100. Assume during each period the stock

Please run the following two binomial models/trees: For a American Put, assume: a So = $98, X = $100. Assume during each period the stock will either rise 5.50% or fall 4.50%. Assume the risk free rate of return per period is 1.00%. Run a 3-periodode model assuming the put expiration is at the third period. You will come up with 10 valuations for the put--please provide all 10. You must watch for early exercise! Remember the put would never trade below its intrinsic value, so if the binomial valuation is below the put's intrinsic value, you should use the intrinsic valuation of the put!!!! Please run the following two binomial models/trees: For a American Put, assume: a So = $98, X = $100. Assume during each period the stock will either rise 5.50% or fall 4.50%. Assume the risk free rate of return per period is 1.00%. Run a 3-periodode model assuming the put expiration is at the third period. You will come up with 10 valuations for the put--please provide all 10. You must watch for early exercise! Remember the put would never trade below its intrinsic value, so if the binomial valuation is below the put's intrinsic value, you should use the intrinsic valuation of the put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts