Question: Please see attached comments, notes, and assumptions. Please prepare the balance sheet, income statement, and statement of cash flow. (IN EXCEL FORMAT) whats missing? leave

Please see attached comments, notes, and assumptions.

Please prepare the balance sheet, income statement, and statement of cash flow. (IN EXCEL FORMAT)

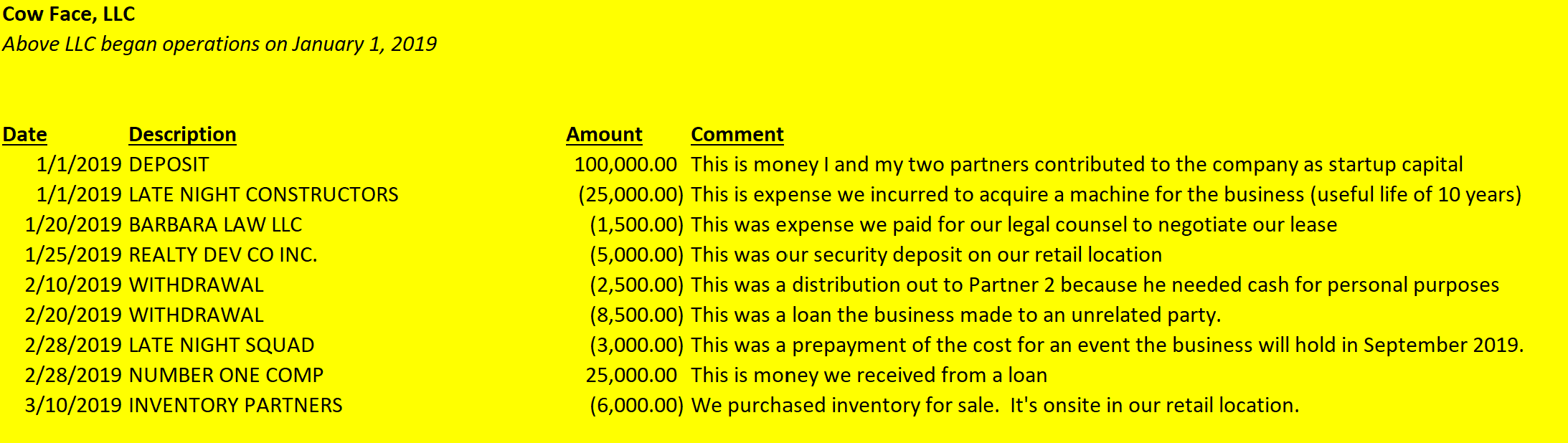

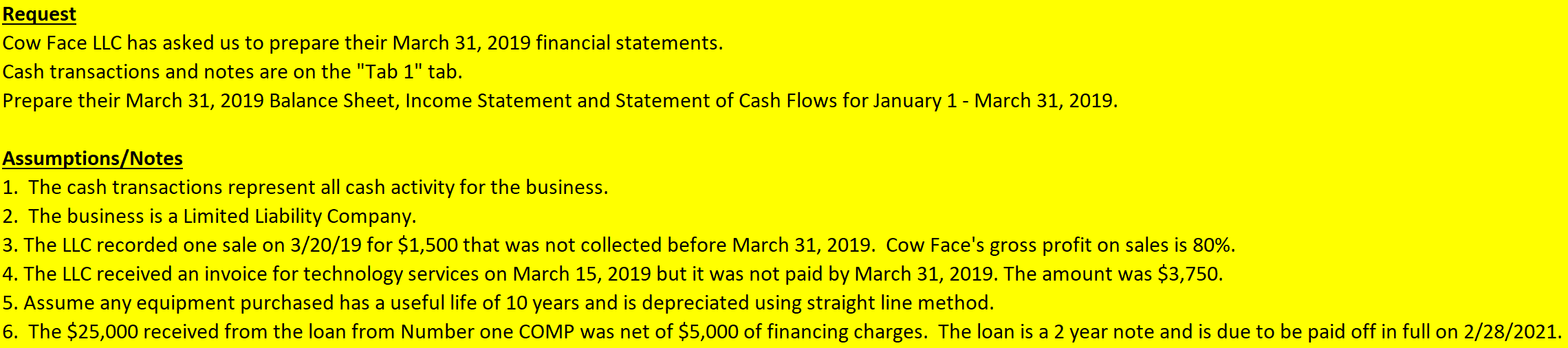

Cow Face, LLC Above LLC began operations on January 1, 2019 Cow Face LLC has asked us to prepare their March 31, 2019 financial statements. Cash transactions and notes are on the \"Tab 1\" tab. Prepare their March 31, 2019 Balance Sheet, Income Statement and Statement of Cash Flows for January 1 - March 31, 2019. Assumptions/Notes 1. The cash transactions represent all cash activity for the business. 2. The business is a Limited Liability Company. 3. The LLC recorded one sale on 3/20/19 for \\( \\$ 1,500 \\) that was not collected before March 31, 2019. Cow Face's gross profit on sales is \80. 4. The LLC received an invoice for technology services on March 15, 2019 but it was not paid by March 31, 2019. The amount was \\( \\$ 3,750 \\). 5. Assume any equipment purchased has a useful life of 10 years and is depreciated using straight line method. 6. The \\( \\$ 25,000 \\) received from the loan from Number one COMP was net of \\( \\$ 5,000 \\) of financing charges. The loan is a 2 year note and is due to be paid off in full on \\( 2 / 28 / 2021 \\). Cow Face, LLC Above LLC began operations on January 1, 2019 Cow Face LLC has asked us to prepare their March 31, 2019 financial statements. Cash transactions and notes are on the \"Tab 1\" tab. Prepare their March 31, 2019 Balance Sheet, Income Statement and Statement of Cash Flows for January 1 - March 31, 2019. Assumptions/Notes 1. The cash transactions represent all cash activity for the business. 2. The business is a Limited Liability Company. 3. The LLC recorded one sale on 3/20/19 for \\( \\$ 1,500 \\) that was not collected before March 31, 2019. Cow Face's gross profit on sales is \80. 4. The LLC received an invoice for technology services on March 15, 2019 but it was not paid by March 31, 2019. The amount was \\( \\$ 3,750 \\). 5. Assume any equipment purchased has a useful life of 10 years and is depreciated using straight line method. 6. The \\( \\$ 25,000 \\) received from the loan from Number one COMP was net of \\( \\$ 5,000 \\) of financing charges. The loan is a 2 year note and is due to be paid off in full on \\( 2 / 28 / 2021 \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts