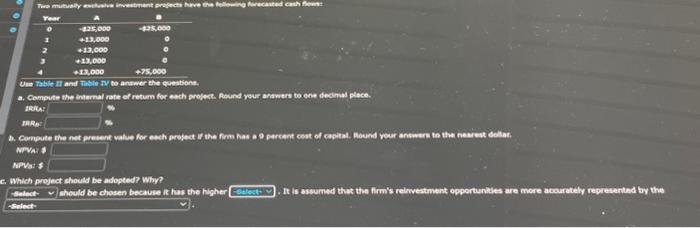

Question: please see attached Two mutually exclusive investment projects have the following forecasted cash flow Year 0 -425,000 -$25,000 1 +13,000 +13,000 +13,000 +13,000 +75,000 Use

Two mutually exclusive investment projects have the following forecasted cash flow Year 0 -425,000 -$25,000 1 +13,000 +13,000 +13,000 +13,000 +75,000 Use Table II and Table IV to answer the questions. a. Compute the internal rate of return for each project. Round your answers to one decimal place. IRRAT IRR & Compute the net present value for each project of the firm has a 9 percent cost of capital. Round your answers to the nearest dollar. NPVA: $ NPV: $ c. Which project should be adopted? Why? Select should be chosen because it has the higher Select-v -Select- It is assumed that the firm's reinvestment opportunities are more accurately represented by the c. Which project should be adopted? Why? -Select- -Select- Project A Project B 9 should be chosen because it has c. Which project should be adopted? Why? -Select- -Select- should be chosen because it has the higher -Select- -Select- NPV IRR It is assumed t c. Which project should be adopted? Why? -Select- -Select- -Select- firm's cost of capital unique internal rate of return of either project lao should be chosen because it has the high

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts