Question: please see the attached docs and pics. Content x / Review Test S. X / Take Test IN: ( X Case Study: Th X Case

please see the attached docs and pics.

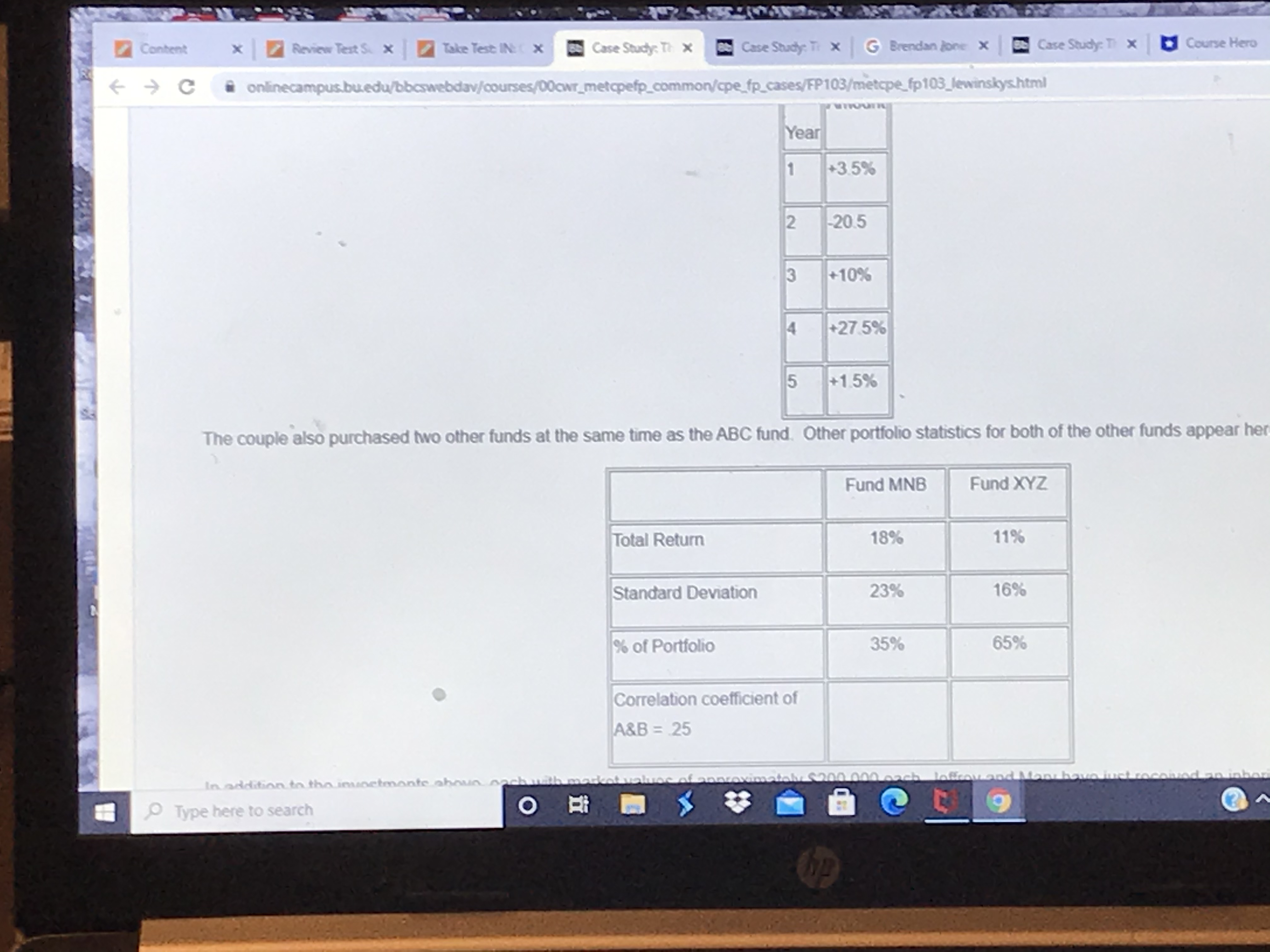

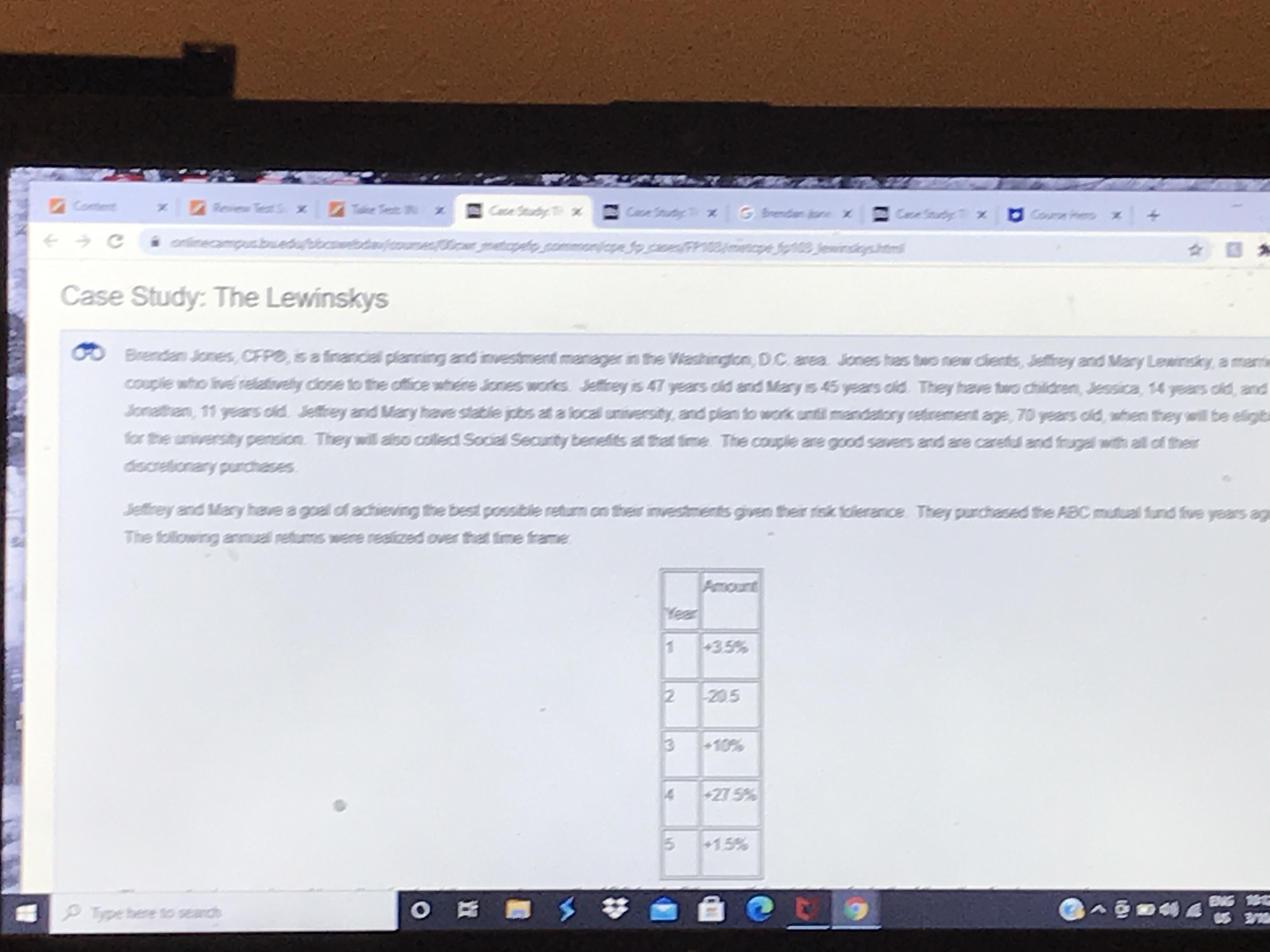

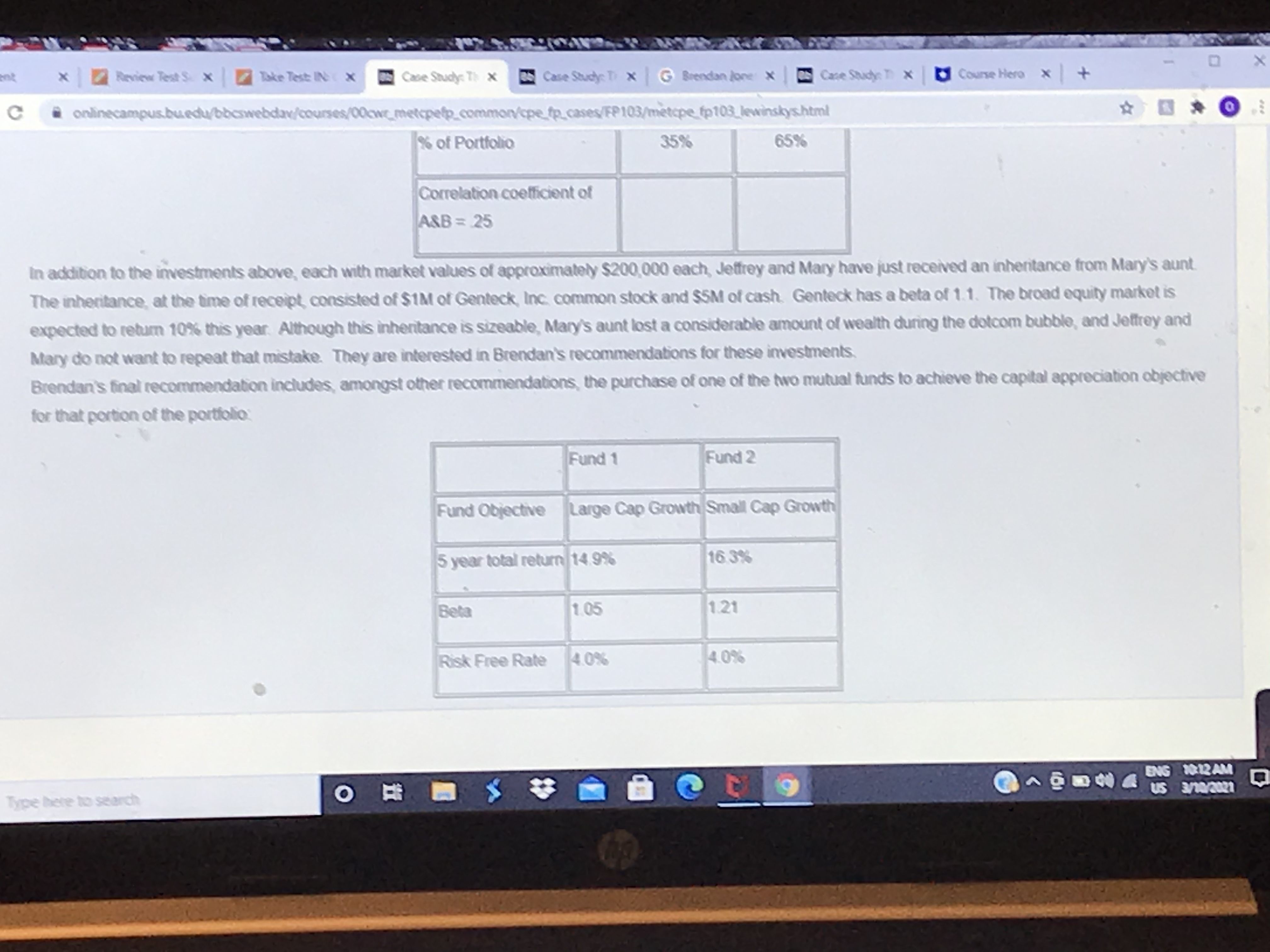

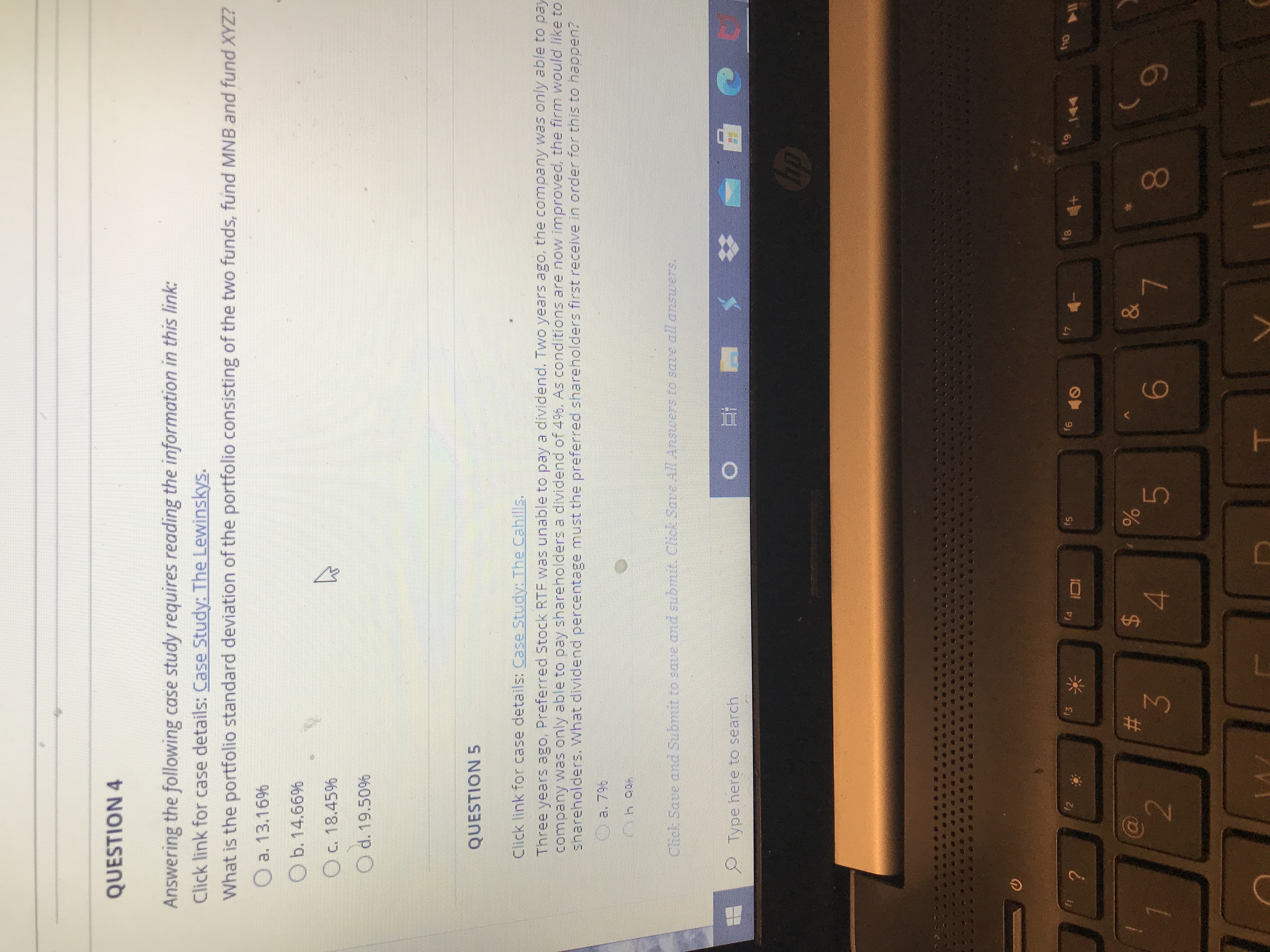

Content x / Review Test S. X / Take Test IN: ( X Case Study: Th X Case Study: Ti X G Brendan Jone x B Case Study: Ti x Course Hero -> C i onlinecampus.bu.edu/bbcswebdav/courses/00cwr_metcpefp_common/cpe_fp_cases/FP103/metope_fp103_lewinskys.html Year +3.5% 2 -20.5 3 +10% 4 +27 5% +1.5% The couple also purchased two other funds at the same time as the ABC fund. Other portfolio statistics for both of the other funds appear he Fund MNB Fund XYZ Total Return 18% 11% Standard Deviation 23% 16%% % of Portfolio 35% 65% Correlation coefficient of A&B = 25 In addition to tho invoetments shown Type here to search OComtere Case Study: The Lewinskys FO Brendan jones, OFPB, is a financial planning and investment manager in the Washington, D C. area. Jones has two new clients, Jeffrey and Mary Lewinsky, a man couple who live relatively close to the office where Jones works. Jeffrey is 47 years old and Mary is 45 years old. They have two children, Jessica, 14 years old, and Jonathan, 11 years old. Jefrey and Mary have stable jobs at a local university, and plan to work onil mandatory retirement age, 70 years old, when they will be eligt for the university pension. They will also called Social Security benefits at that time. The couple are good savers and are careful and frugal with all of their discretionary purchases. Jeffrey and Mary have a goal of achieving the best possible return Idievance e. They purchased the ABC mutual fund five years ag The following annual retums were realized over thet time frame Amount +35% 2 205 3 #10% $21 5% 5 $15% Type here to searchx / Review Test S. X / Take Test IN( X Case Study: Th x 35 Case Study: Ti X G Brendan Jone X | 25 Case Study: T X | Course Hero * + C onlinecampus.buedu/bbeswebday/courses/00cwr_metepefp_common/cpe fp_ cases/FP103/metepe_fp103_lewinskys.html of Portfolio 35%% 65 Correlation coefficient of A&B= 25 In addition to the investments above, each with market values of approximately $200,000 each, Jeffrey and Mary have just received an inheritance from Mary's aunt. The inheritance, at the time of receipt, consisted of $1M of Genteck, Inc. common stock and $5M of cash. Genteck has a beta of 1.1. The broad equity market is expected to return 10% this year. Although this inheritance is sizeable, Mary's aunt lost a considerable amount of wealth during the dotcom bubble, and Jeffrey and Mary do not want to repeat that mistake. They are interested in Brendan's recommendations for these investments, Brendan's final recommendation includes, amongst other recommendations, the purchase of one of the two mutual funds to achieve the capital appreciation objective for that portion of the portfolio Fund 1 Fund 2 Fund Objective Large Cap Growth Small Cap Growth 5 year total return 14.9% 16 3% Beta 1.05 1.21 Risk Free Rate 4 0% 4 0%% Type here to search 9 ENG 10:12 AM a/0/2021QUESTION 4 Answering the following case study requires reading the information in this link: Click link for case details: Case Study: The Lewinskys. What is the portfolio standard deviation of the portfolio consisting of the two funds, fund MNB and fund XYZ? O a. 13.16% O b. 14.66% O c. 18.45% O d. 19.50% QUESTION 5 Click link for case details: Case Study: The Cahills, Three years ago, Preferred Stock RTF was unable to pay a dividend. Two years ago, the company was only able to pa company was only able to pay shareholders a dividend of 49%. As conditions are now improved, the firm would like to shareholders. What dividend percentage must the preferred shareholders first receive in order for this to happen? a. 7% Click Save and Submit Type here to search hp ? 2 13 5 16 19 10 144 % 8 5 8