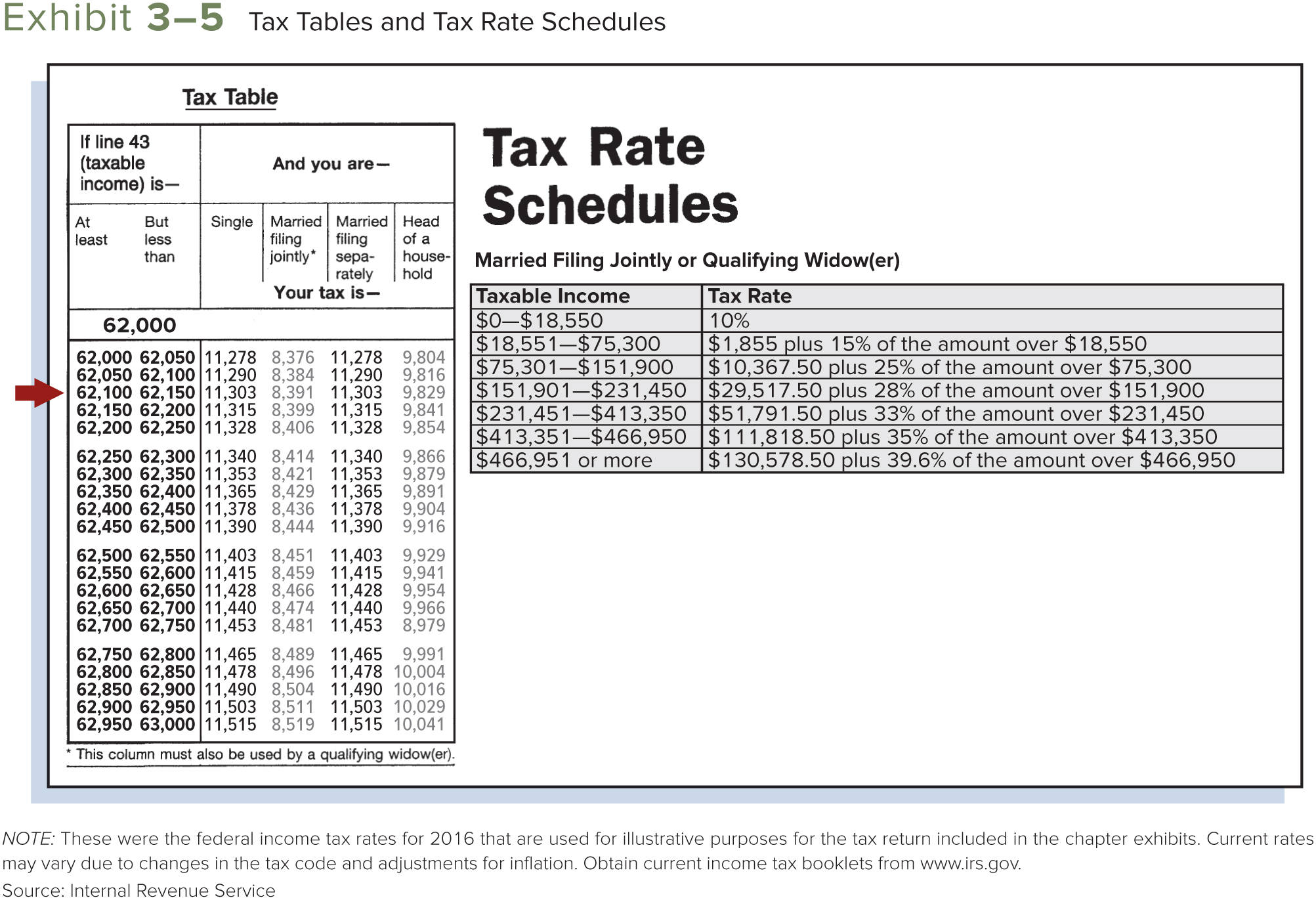

Question: Using the tax table in Exhibit 3-5 determine the amount of taxes for the following situations: a. a head of household with taxable income of

Using the tax table in Exhibit 3-5 determine the amount of taxes for the following situations:

a. a head of household with taxable income of $62,525

b. a single person with taxable income of $62,001

c. A married person filing a separate return with taxable income of $62,365

Exhibit 3-5 Tax Tables and Tax Rate Schedules Tax Table If line 43 (taxable And you are- Tax Rate income) is- At But Single Married Married Head Schedules least less filing filing of a than jointly sepa- house- rately hold Married Filing Jointly or Qualifying Widow(er) Your tax is- Taxable Income Tax Rate 62,000 $0-$18,550 10% 62,000 62,050 11,278 8,376 11,278 9,804 $18,551-$75,300 $1,855 plus 15% of the amount over $ 18,550 62,050 62, 100 11,290 8,384 11,290 9,816 $75,301-$151,900 $10,367.50 plus 25% of the amount over $75,300 62, 100 62, 150 11,303 8,391 11,303 9,829 8,399 11,315 $ 151,901-$231,450 $29,517.50 plus 28% of the amount over $ 151,900 62, 150 62,200 11,315 9.841 62,200 62,250 11,328 8,406 11,328 9,854 $231,451-$413,350 $51,791.50 plus 33% of the amount over $231,450 62,250 62,300 11,340 8,414 11,340 $413,351-$466,950 $1 11,818.50 plus 35% of the amount over $413,350 8,421 11,353 9,866 62,300 62,350 11,353 9.879 $466,951 or more $130,578.50 plus 39.6% of the amount over $466,950 62,350 62,400 11,365 8,429 11,365 9.891 62,400 62,450 11,378 8,436 11,378 9,904 62,450 62,500 11,390 8,444 11,390 9.916 62,500 62,550 11,403 8,451 62,550 62,600 11,415 8,459 11,403 9,929 11,415 9.941 62,600 62,650 11,428 8,466 11,428 9,954 62,650 62,700 11,440 8,474 11,440 9,966 62,700 62,750 11,453 8,481 11,453 8,979 62,750 62,800 11,465 8,489 11,465 9,991 62,800 62,850 11,478 8,496 11,478 10,004 62,850 62,900 11,490 8,504 11,490 10,016 62,900 62,950 11,503 8,511 11,503 10,029 62,950 63,000 11,515 8,519 11,515 10,041 * This column must also be used by a qualifying widow(er). VOTE: These were the federal income tax rates for 2016 that are used for illustrative purposes for the tax return included in the chapter exhibits. Current rates may vary due to changes in the tax code and adjustments for inflation. Obtain current income tax booklets from www.irs.gov. Source: Internal Revenue Service