Question: Please select 3 true statements! It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide

Please select 3 true statements!

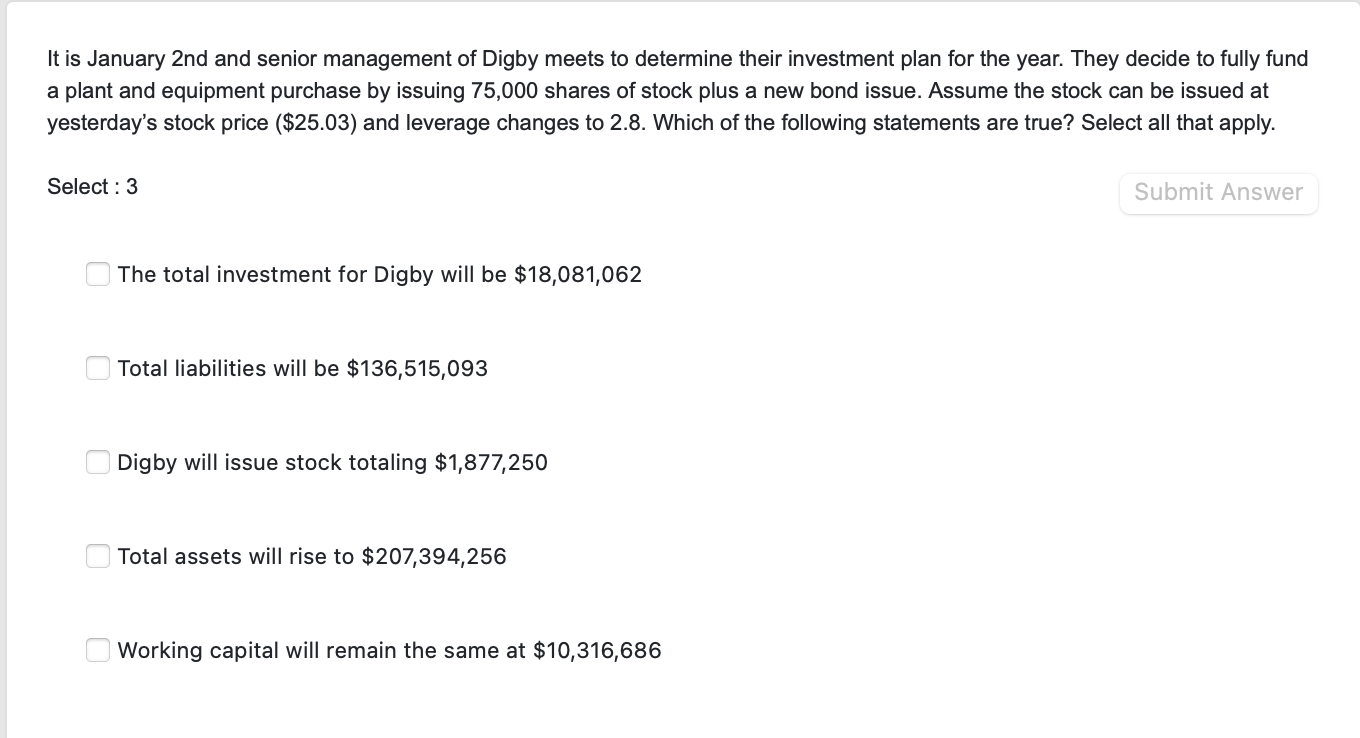

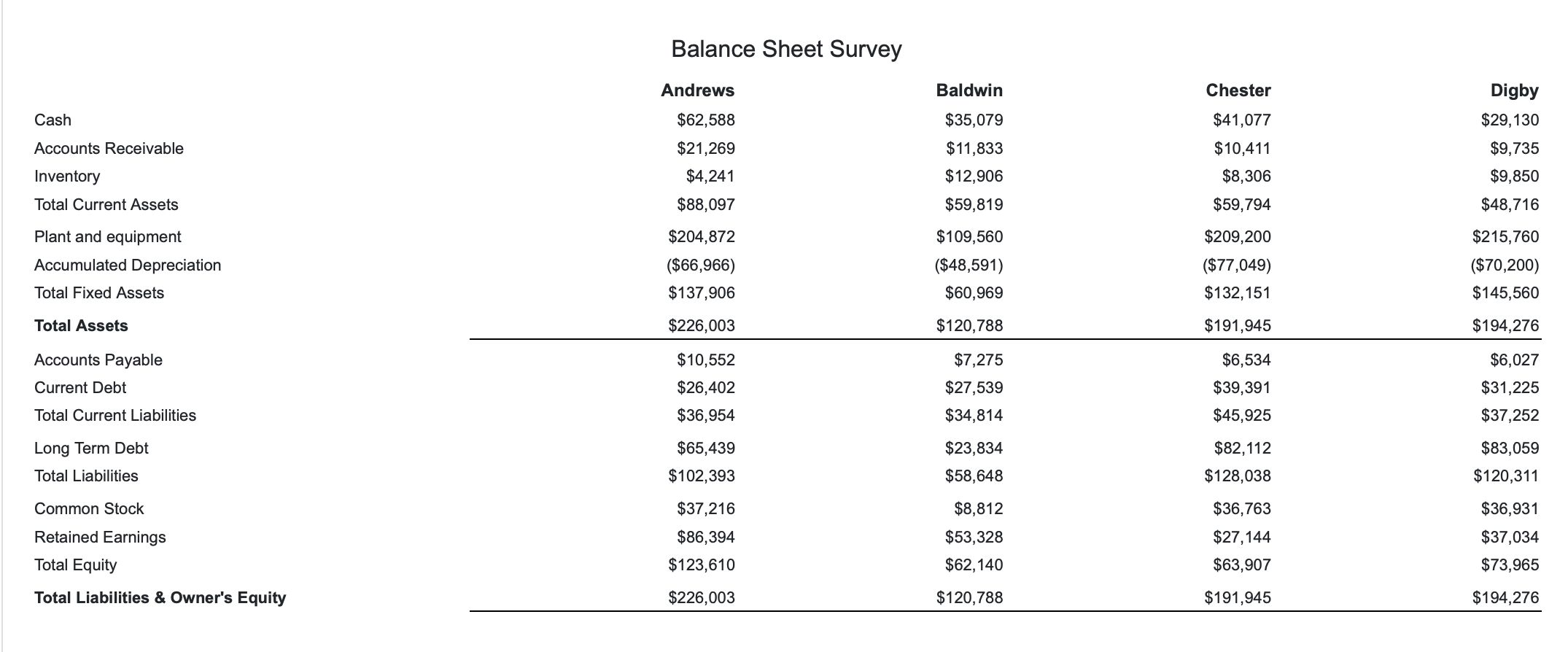

It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 75,000 shares of stock plus a new bond issue. Assume the stock can be issued at yesterday's stock price ($25.03) and leverage changes to 2.8. Which of the following statements are true? Select all that apply. Select : 3 Submit Answer The total investment for Digby will be $18,081,062 Total liabilities will be $136,515,093 Digby will issue stock totaling $1,877,250 Total assets will rise to $207,394,256 Working capital will remain the same at $10,316,686 Balance Sheet Survey Andrews Baldwin Chester Cash $62,588 $35,079 Accounts Receivable $21,269 $41,077 $10,411 $8,306 $59,794 Digby $29,130 $9,735 $9,850 $48,716 $11,833 $12,906 $59,819 Inventory Total Current Assets $4,241 $88,097 Plant and equipment Accumulated Depreciation $204,872 ($66,966) $137,906 $109,560 ($48,591) $60,969 $209,200 ($77,049) $132, 151 $215,760 ($70,200) $145,560 Total Fixed Assets Total Assets $226,003 $120,788 $191,945 $194,276 Accounts Payable $10,552 $6,027 Current Debt $26,402 $36,954 $7,275 $27,539 $34,814 $6,534 $39,391 $45,925 $31,225 $37,252 Total Current Liabilities Long Term Debt $65,439 $102,393 $23,834 $58,648 $82,112 $128,038 $83,059 $120,311 Total Liabilities Common Stock $37,216 $8,812 $36,931 $86,394 Retained Earnings Total Equity $37,034 $36,763 $27,144 $63,907 $53,328 $62,140 $123,610 $73,965 Total Liabilities & Owner's Equity $226,003 $120,788 $191,945 $194,276

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts