Question: Please select a stock or stock index from WIND database or yahoo finance. Suppose that the risk-free rate is rr = 1%. You are required

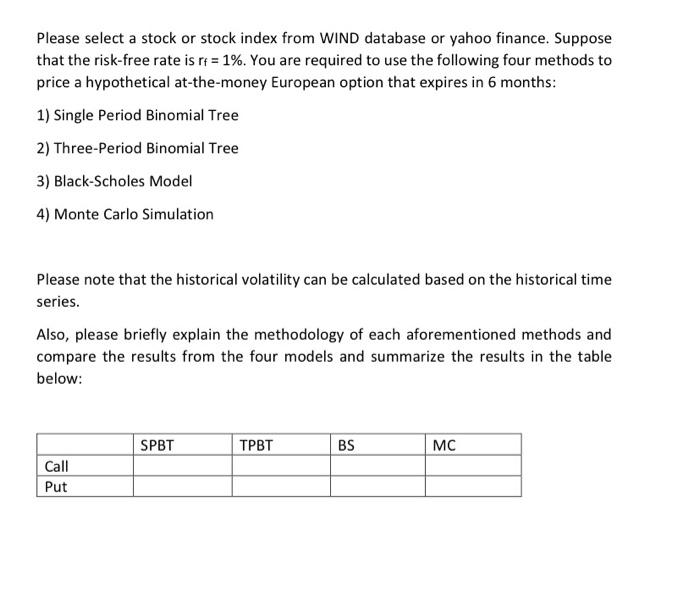

Please select a stock or stock index from WIND database or yahoo finance. Suppose that the risk-free rate is r4 = 1%. You are required to use the following four methods to price a hypothetical at-the-money European option that expires in 6 months: 1) Single Period Binomial Tree 2) Three-Period Binomial Tree 3) Black-Scholes Model 4) Monte Carlo Simulation Please note that the historical volatility can be calculated based on the historical time series. Also, please briefly explain the methodology of each aforementioned methods and compare the results from the four models and summarize the results in the table below: SPBT TPBT BS MC Call Put Please select a stock or stock index from WIND database or yahoo finance. Suppose that the risk-free rate is r4 = 1%. You are required to use the following four methods to price a hypothetical at-the-money European option that expires in 6 months: 1) Single Period Binomial Tree 2) Three-Period Binomial Tree 3) Black-Scholes Model 4) Monte Carlo Simulation Please note that the historical volatility can be calculated based on the historical time series. Also, please briefly explain the methodology of each aforementioned methods and compare the results from the four models and summarize the results in the table below: SPBT TPBT BS MC Call Put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts