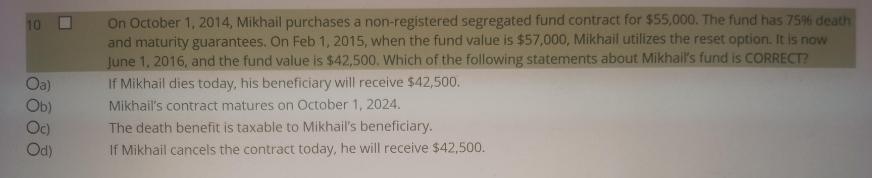

Question: On October 1, 2014, Mikhail purchases a non-registered segregated fund contract for $55,000. The fund has 75% death and maturity guarantees. On Feb 1,

On October 1, 2014, Mikhail purchases a non-registered segregated fund contract for $55,000. The fund has 75% death and maturity guarantees. On Feb 1, 2015, when the fund value is $57,000, Mikhail utilizes the reset option. It is now June 1, 2016, and the fund value is $42,500. Which of the following statements about Mikhal's fund is CORRECT? If Mikhail dies today, his beneficiary will receive $42,500. 10 0 Oa) Ob) Oc) Od) Mikhail's contract matures on October 1, 2024. The death benefit is taxable to Mikhail's beneficiary. If Mikhail cancels the contract today, he will receive $42,500.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Option A is correct If Mikhail dies ... View full answer

Get step-by-step solutions from verified subject matter experts