Question: Please show all calculations and explaination. USE BA II PLUS CALC (if possible) NO EXCEL. THANK YOU! USE 4 DECIMAL PLACES (rounded)- i.e., 1.2345% or

Please show all calculations and explaination. USE BA II PLUS CALC (if possible) NO EXCEL. THANK YOU!

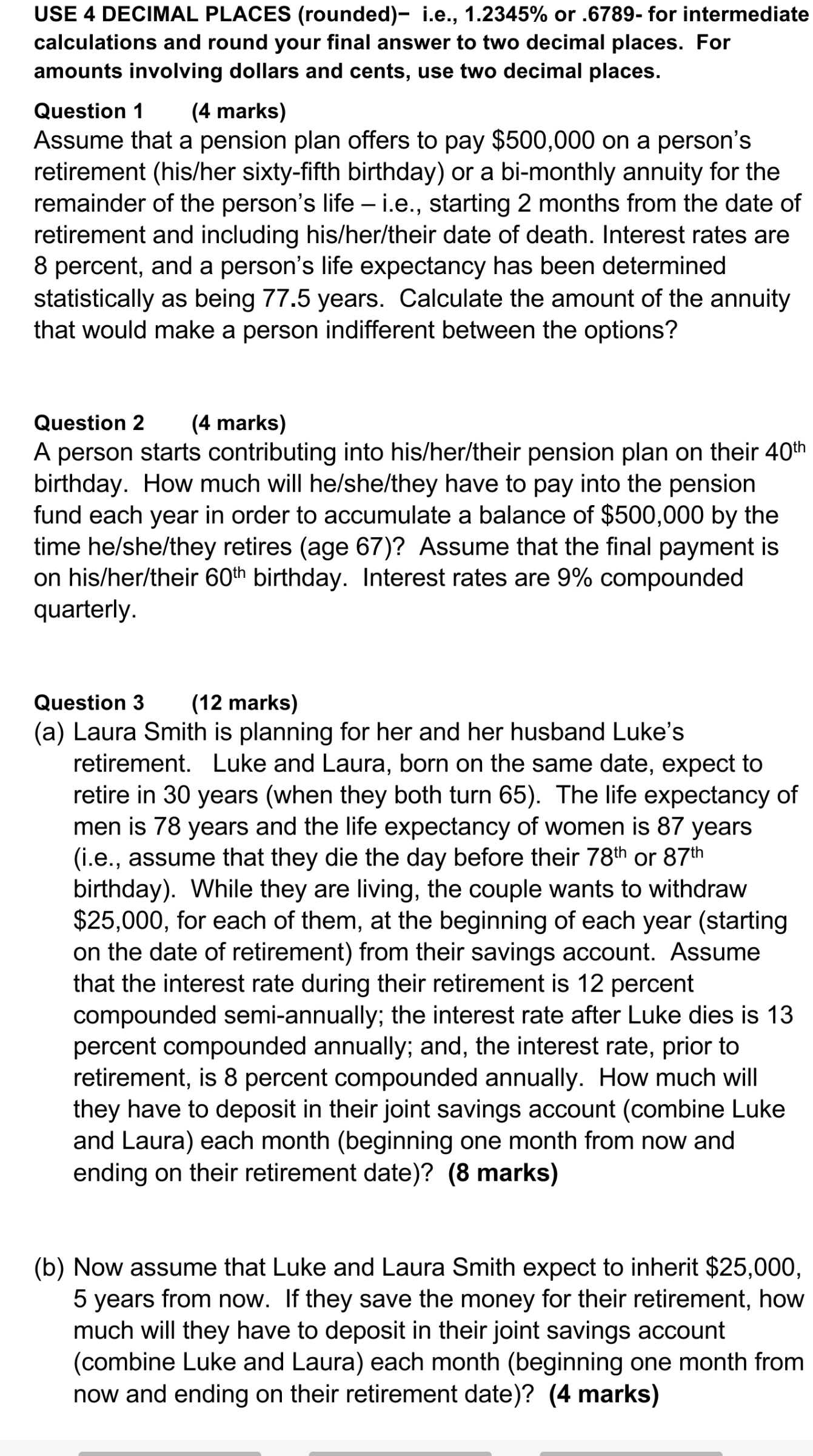

USE 4 DECIMAL PLACES (rounded)- i.e., 1.2345% or .6789- for intermediate calculations and round your final answer to two decimal places. For amounts involving dollars and cents, use two decimal places. Question 1 (4 marks) Assume that a pension plan offers to pay $500,000 on a person's retirement (his/her sixty-fth birthday) or a bi-monthly annuity for the remainder of the person's life i.e., starting 2 months from the date of retirement and including his/her/their date of death. Interest rates are 8 percent, and a person's life expectancy has been determined statistically as being 77.5 years. Calculate the amount of the annuity that would make a person indifferent between the options? Question 2 (4 marks) A person starts contributing into his/her/their pension plan on their 40th birthday. How much will he/she/they have to pay into the pension fund each year in order to accumulate a balance of $500,000 by the time he/she/they retires (age 67)? Assume that the nal payment is on his/her/their 60th birthday. Interest rates are 9% compounded quarterly. Question 3 (12 marks) (a) Laura Smith is planning for her and her husband Luke's retirement. Luke and Laura, born on the same date, expect to retire in 30 years (when they both turn 65). The life expectancy of men is 78 years and the life expectancy of women is 87 years (i.e., assume that they die the day before their 78th or 87th birthday). While they are living, the couple wants to withdraw $25,000, for each of them, at the beginning of each year (starting on the date of retirement) from their savings account. Assume that the interest rate during their retirement is 12 percent compounded semi-annually; the interest rate after Luke dies is 13 percent compounded annually; and, the interest rate, prior to retirement, is 8 percent compounded annually. How much will they have to deposit in theirjoint savings account (combine Luke and Laura) each month (beginning one month from now and ending on their retirement date)? (8 marks) (b) Now assume that Luke and Laura Smith expect to inherit $25,000, 5 years from now. If they save the money for their retirement, how much will they have to deposit in theirjoint savings account (combine Luke and Laura) each month (beginning one month from now and ending on their retirement date)? (4 marks)