Question: Please show all calculations for both questions. Thann you! Answer each question as detailed as possible. To receive full credit, you must provide all calculations.

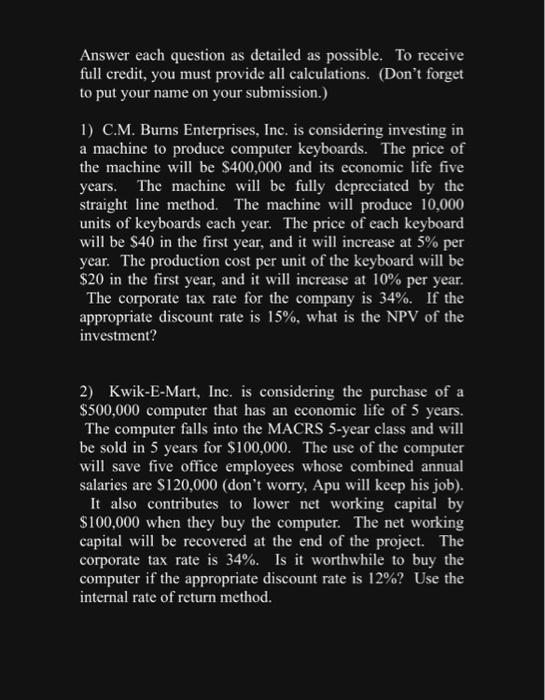

Answer each question as detailed as possible. To receive full credit, you must provide all calculations. (Don't forget to put your name on your submission.) 1) C.M. Burns Enterprises, Inc. is considering investing in a machine to produce computer keyboards. The price of the machine will be $400,000 and its economic life five years. The machine will be fully depreciated by the straight line method. The machine will produce 10,000 units of keyboards each year. The price of each keyboard will be $40 in the first year, and it will increase at 5% per year. The production cost per unit of the keyboard will be $20 in the first year, and it will increase at 10% per year. The corporate tax rate for the company is 34%. If the appropriate discount rate is 15%, what is the NPV of the investment? 2) Kwik-E-Mart, Inc. is considering the purchase of a $500,000 computer that has an economic life of 5 years. The computer falls into the MACRS 5 -year class and will be sold in 5 years for $100,000. The use of the computer will save five office employees whose combined annual salaries are $120,000 (don't worry, Apu will keep his job). It also contributes to lower net working capital by $100,000 when they buy the computer. The net working capital will be recovered at the end of the project. The corporate tax rate is 34%. Is it worthwhile to buy the computer if the appropriate discount rate is 12% ? Use the internal rate of return method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts