Question: Please show all calculations in excel! ( NEED HELP QUICK ) Calandra Panagakos works for CIBC Currency Funds in Toronto. Calandra is something of a

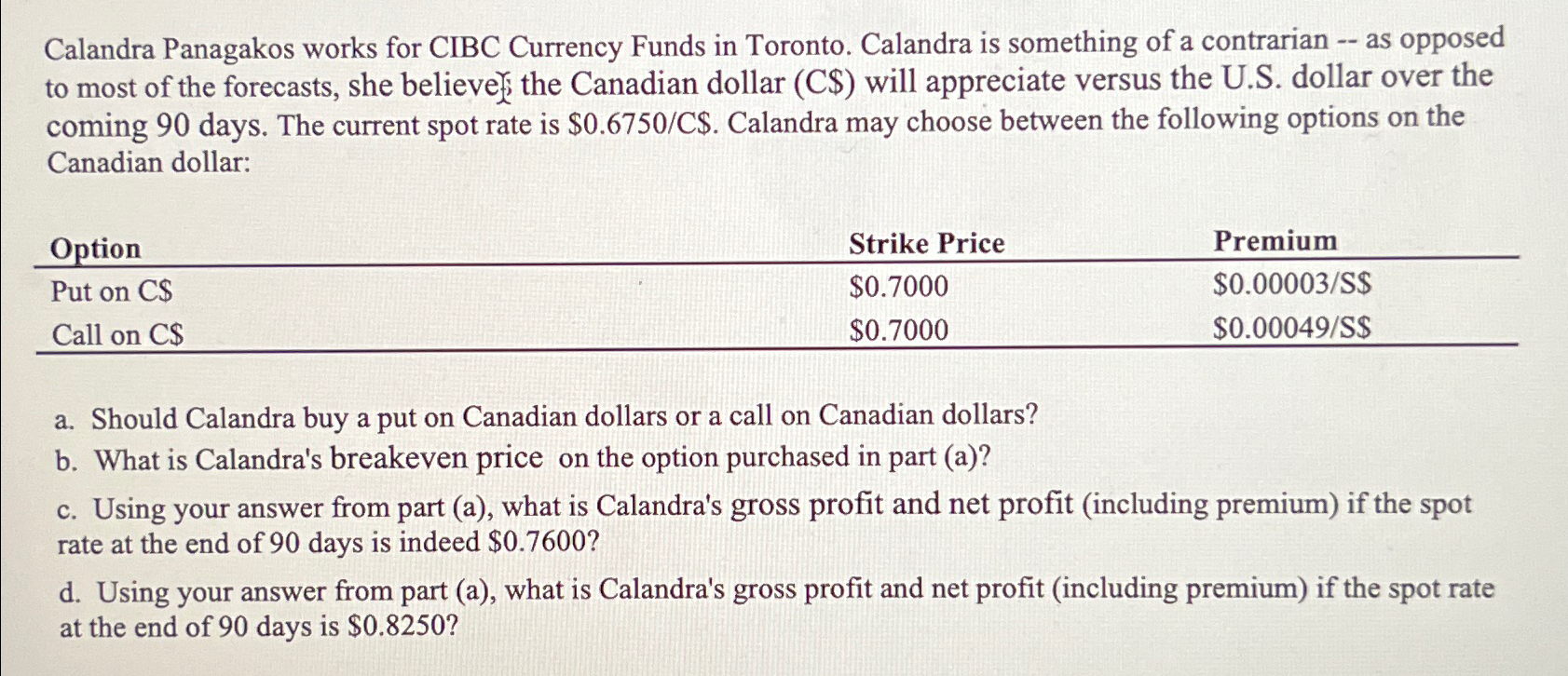

Please show all calculations in excel! NEED HELP QUICK Calandra Panagakos works for CIBC Currency Funds in Toronto. Calandra is something of a contrarian as opposed to most of the forecasts, she believer; the Canadian dollar C$ will appreciate versus the US dollar over the coming days. The current spot rate is $$ Calandra may choose between the following options on the Canadian dollar:

tableOptionStrike Price,PremiumPut on C$$$ S$Call on C$$$ S$

a Should Calandra buy a put on Canadian dollars or a call on Canadian dollars?

b What is Calandra's breakeven price on the option purchased in part a

c Using your answer from part a what is Calandra's gross profit and net profit including premium if the spot rate at the end of days is indeed $

d Using your answer from part a what is Calandra's gross profit and net profit including premium if the spot rate at the end of days is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock