Question: Please show all equations and work as necessary. You manage a risky portfolio with an expected rate of return of 10% and a standard deviation

Please show all equations and work as necessary.

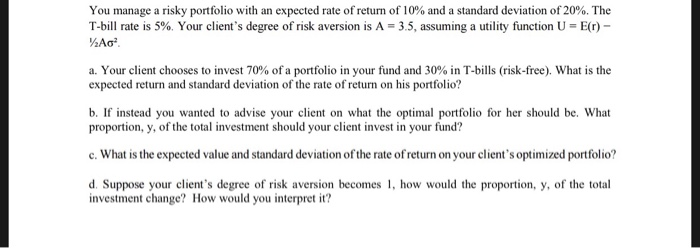

You manage a risky portfolio with an expected rate of return of 10% and a standard deviation of 20%. The T-bill rate is 5%. Your client's degree of risk aversion is A-35, assuming a utility function U-E(r)- a. Your client chooses to invest 70% of a portfolio in your fund and 30% in T-bills (risk-free). What is the expected return and standard deviation of the rate of return on his portfolio? b. If instead you wanted to advise your client on what the optimal portfolio for her should be. What proportion, y, of the total investment should your client invest in your fund? c. What is the expected value and standard deviation of the rate of return on your client's optimized portfolio? d. Suppose your client's degree of risk aversion becomes 1, how would the proportion, y, of the total investment change? How would you interpret it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts