Question: Please show all equations and work as needed. 7. Behavioral finance differs from the standard model of finance because behavioral finance A. Precludes the impact

Please show all equations and work as needed.

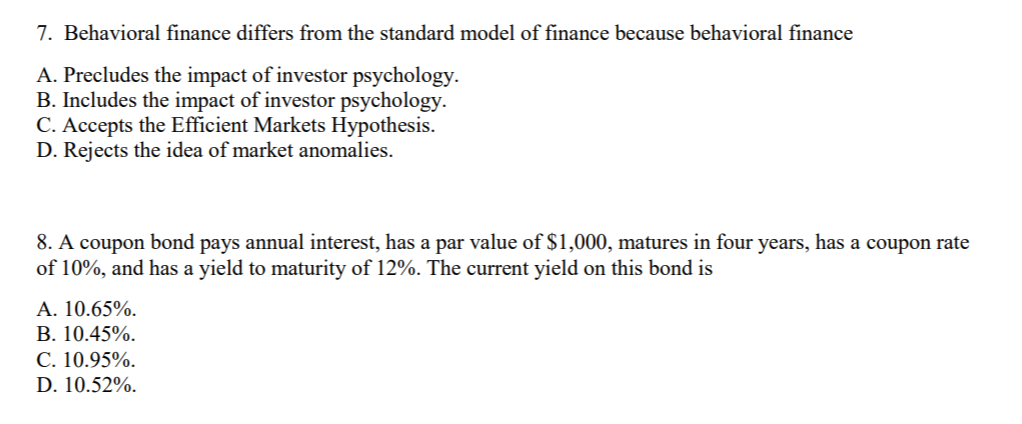

7. Behavioral finance differs from the standard model of finance because behavioral finance A. Precludes the impact of investor psychology. B. Includes the impact of investor psychology C. Accepts the Efficient Markets Hypothesis. D. Rejects the idea of market anomalies. 8. A coupon bond pays annual interest, has a par value of $1,000, matures in four years, has a coupon rate of 10%, and has a yield to maturity of 12%. The current yield on this bond is A. 10.65%. B. 10.45%. C. 10.95%. D. 10.52%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts