Question: Please show all equations and work as needed. 9. A coupon bond that pays interest semi-annually has a par value of S1,000, matures in seven

Please show all equations and work as needed.

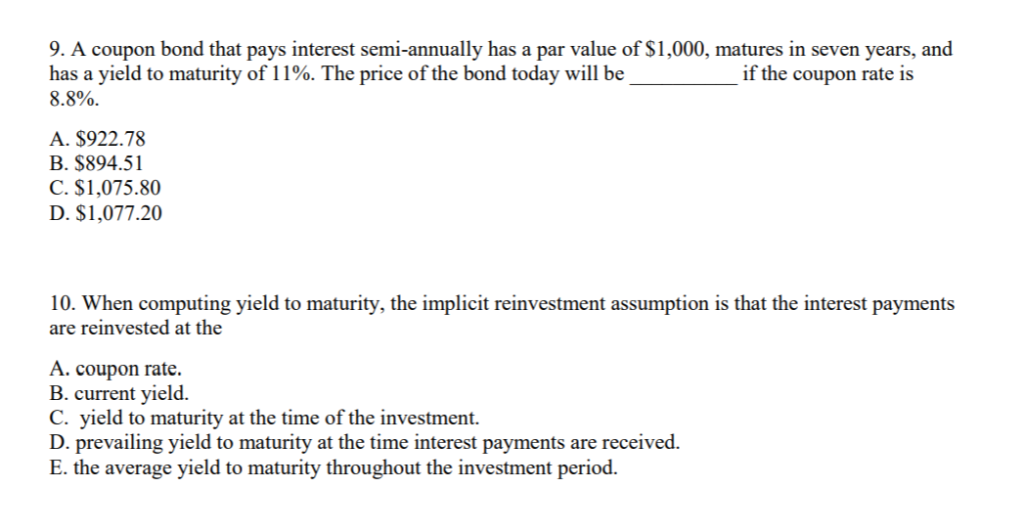

9. A coupon bond that pays interest semi-annually has a par value of S1,000, matures in seven years, and has a yield to maturity of 1 1%. The price of the bond today will be 8.8%. if the coupon rate is A. $922.78 B. $894.51 C. $1,075.80 D. $1,077.20 10. When computing yield to maturity, the implicit reinvestment assumption is that the interest payments are reinvested at the A. coupon rate. B. current yield. C. yield to maturity at the time of the investment. D. prevailing yield to maturity at the time interest payments are received E. the average yield to maturity throughout the investment period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts