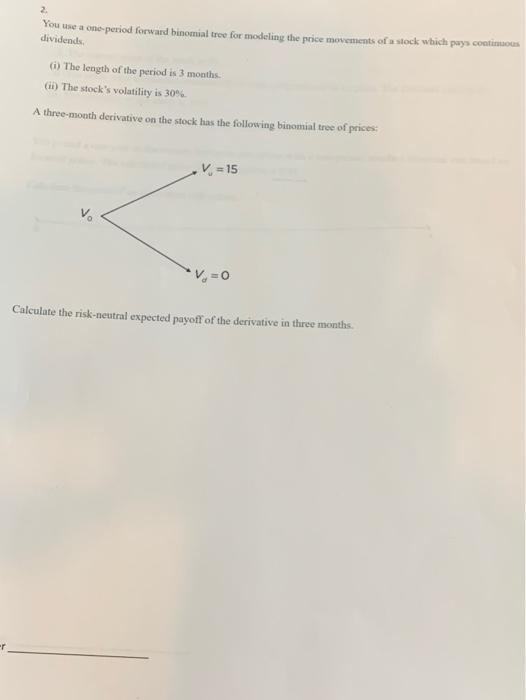

Question: please show all formulas 2. You use a one period forward binomial tree for modeling the price movements of a stock which pays continuades dividends,

2. You use a one period forward binomial tree for modeling the price movements of a stock which pays continuades dividends, (1) The length of the period is 3 months (iThe stock's volatility is 30% A three-month derivative on the stock has the following binomial tree of prices V = 15 V. v=0 Calculate the risk-neutral expected payoff of the derivative in three months. 2. You use a one period forward binomial tree for modeling the price movements of a stock which pays continuades dividends, (1) The length of the period is 3 months (iThe stock's volatility is 30% A three-month derivative on the stock has the following binomial tree of prices V = 15 V. v=0 Calculate the risk-neutral expected payoff of the derivative in three months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts