Question: Please show all formulas and work done for every problem Problem 16:Financing A Home After making a down payment of $25,000, the Meyers need to

Please show all formulas and work done for every problem

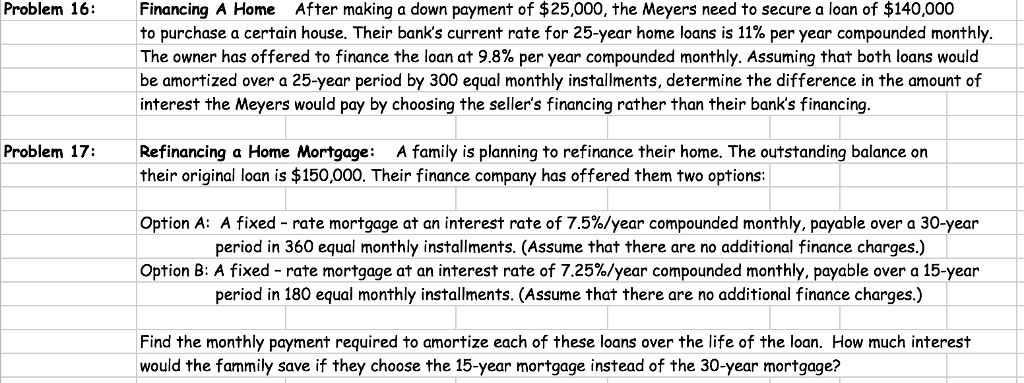

Problem 16:Financing A Home After making a down payment of $25,000, the Meyers need to secure a loan of $140,000 to purchase a certain house. Their bank's current rate for 25-year home loans is 11% per year compounded monthly The owner has offered to finance the loan at 9.8% per year compounded monthly. Assuming that both loans would be amortized over a 25-year period by 300 equal monthly installments, determine the difference in the amount of interest the Meyers would pay by choosing the seller's financing rather than their banks financing Problem 17:Refinancing a Home Mortgage: A family is planning to refinance their home. The outstanding balance on their original loan is $150,000. Their finance company has offered them two options Option A: A fixed-rate mortgage at an interest rate of 7.5%/year compounded monthly, payable over a 30-year Option B: A fixed-rate mortgage at an interest rate of 7.25%/year compounded monthly, payable over a 15-year period in 360 equal monthly installments. (Assume that there are no additional finance charges.) period in 180 equal monthly installments. (Assume that there are no additional finance charges.) Find the monthly payment required to amortize each of these loans over the life of the loan. How much interest would the fammily save if they choose the 15-year mortgage instead of the 30-year mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts