Question: please show all solutions (no excel) Please selve and upload this question in 50 minutes. You will have 5 minutes to end your answer to

please show all solutions (no excel)

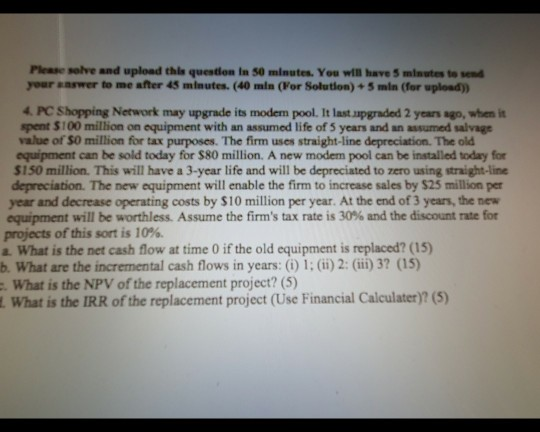

Please selve and upload this question in 50 minutes. You will have 5 minutes to end your answer to me after 45 minutes. (40 min (For Solution) 5 min (for upload)) 4. PC Shopping Network may upgrade its modem pool. It last upgraded 2 years ago, when it spent $100 million on equipment with an assumed life of 5 years and an assumed salvage value of S0 million for tax purposes. The firm uses straight-line depreciation. The old equipment can be sold today for $80 million. A new modem pool can be installed today for $150 million. This will have a 3-year life and will be depreciated to zero using straight-line depreciation. The new equipment will enable the firm to increase sales by S25 million per year and decrease operating costs by $10 million per year. At the end of 3 years, the new equipment will be worthless. Assume the firm's tax rate is 30% and the discount rate for projects of this sort is 10% 2. What is the net cash flow at time 0 if the old equipment is replaced? (15) b. What are the incremental cash flows in years: (i) 1: (i) 2: (iii) 3? (15) What is the NPV of the replacement project? (5) What is the IRR of the replacement project (Use Financial Calculater)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts