Question: PLEASE SHOW ALL STEPS AND CORRECT ANSWER Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of

PLEASE SHOW ALL STEPS AND CORRECT ANSWER

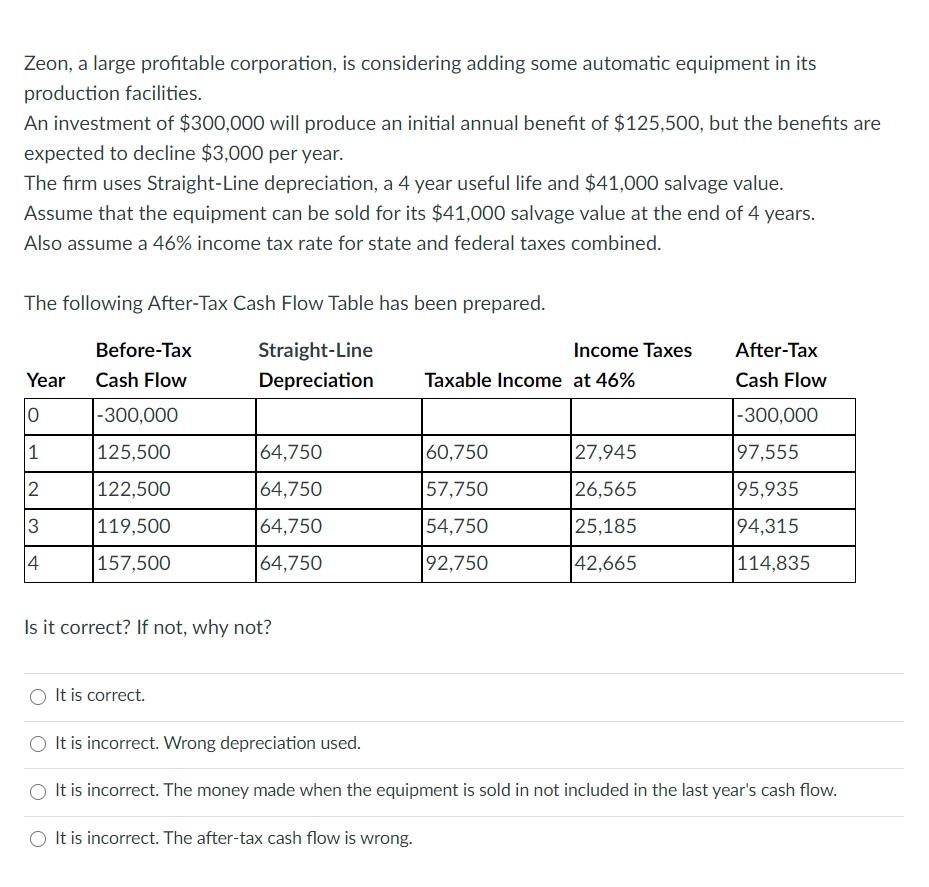

Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $300,000 will produce an initial annual benefit of $125,500, but the benefits are expected to decline $3,000 per year. The firm uses Straight-Line depreciation, a 4 year useful life and $41,000 salvage value. Assume that the equipment can be sold for its $41,000 salvage value at the end of 4 years. Also assume a 46% income tax rate for state and federal taxes combined. The following After-Tax Cash Flow Table has been prepared. Before-Tax Cash Flow Straight-Line Depreciation Income Taxes Taxable income at 46% After-Tax Cash Flow Year 0 |-300,000 -300,000 1 125,500 64,750 60,750 27,945 97,555 N 122,500 64,750 57,750 26,565 95,935 3 119,500 64,750 54,750 25,185 94,315 4 157,500 64,750 92,750 42,665 114,835 Is it correct? If not, why not? It is correct. O It is incorrect. Wrong depreciation used. It is incorrect. The money made when the equipment is sold in not included in the last year's cash flow. It is incorrect. The after-tax cash flow is wrong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts