Question: Please show all steps and Excel formulas. PLEASE SHOW ALL STEPS AND EXCEL FORMULAS. Tohlo 1 - Kav A coumntione Tahle - Canital Rudoetino Analvsis

Please show all steps and Excel formulas.

PLEASE SHOW ALL STEPS AND EXCEL FORMULAS.

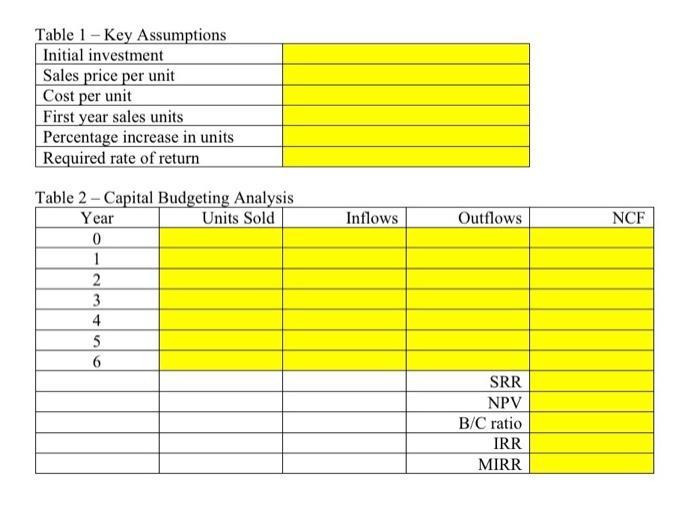

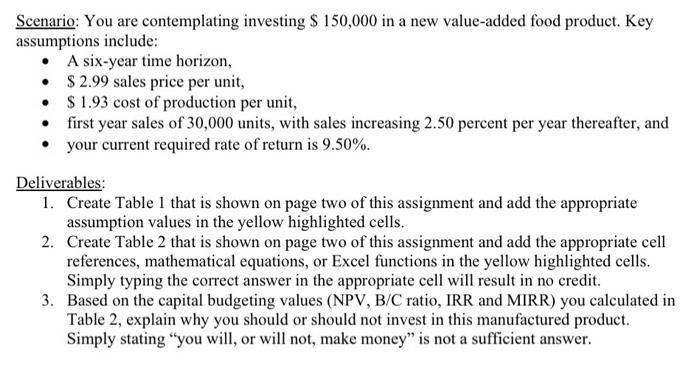

Tohlo 1 - Kav A coumntione Tahle - Canital Rudoetino Analvsis Scenario: You are contemplating investing $150,000 in a new value-added food product. Key assumptions include: - A six-year time horizon, - \$2.99 sales price per unit, - $1.93 cost of production per unit, - first year sales of 30,000 units, with sales increasing 2.50 percent per year thereafter, and - your current required rate of return is 9.50%. Deliverables: 1. Create Table 1 that is shown on page two of this assignment and add the appropriate assumption values in the yellow highlighted cells. 2. Create Table 2 that is shown on page two of this assignment and add the appropriate cell references, mathematical equations, or Excel functions in the yellow highlighted cells. Simply typing the correct answer in the appropriate cell will result in no credit. 3. Based on the capital budgeting values (NPV, B/C ratio, IRR and MIRR) you calculated in Table 2, explain why you should or should not invest in this manufactured product. Simply stating "you will, or will not, make money" is not a sufficient answer. Tohlo 1 - Kav A coumntione Tahle - Canital Rudoetino Analvsis Scenario: You are contemplating investing $150,000 in a new value-added food product. Key assumptions include: - A six-year time horizon, - \$2.99 sales price per unit, - $1.93 cost of production per unit, - first year sales of 30,000 units, with sales increasing 2.50 percent per year thereafter, and - your current required rate of return is 9.50%. Deliverables: 1. Create Table 1 that is shown on page two of this assignment and add the appropriate assumption values in the yellow highlighted cells. 2. Create Table 2 that is shown on page two of this assignment and add the appropriate cell references, mathematical equations, or Excel functions in the yellow highlighted cells. Simply typing the correct answer in the appropriate cell will result in no credit. 3. Based on the capital budgeting values (NPV, B/C ratio, IRR and MIRR) you calculated in Table 2, explain why you should or should not invest in this manufactured product. Simply stating "you will, or will not, make money" is not a sufficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts