Question: PLEASE SHOW ALL STEPS AND FORMULAS SO I MAY UNDERSTAND THESE PRACTICE PROBLEMS! THANK YOU, WILL GIVE THUMBS UP. PLEASE PRINT CLEARLY An investor has

PLEASE SHOW ALL STEPS AND FORMULAS SO I MAY UNDERSTAND THESE PRACTICE PROBLEMS!

THANK YOU, WILL GIVE THUMBS UP. PLEASE PRINT CLEARLY

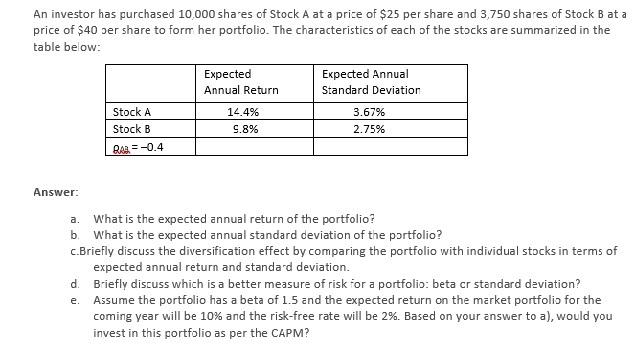

An investor has purchased 10,000 shares of Stock A at a price of $25 per share and 3,750 shares of Stock B at a price of $40 per share to form her portfolio. The characteristics of each of the stocks are summarized in the table below: Expected Expected Annual Annual Return Standard Deviation Stock A 14.4% 3.67% Stock B 9.8% 2.75% RAD=-0.4 Answer: a. What is the expected annual return of the portfolio? b. What is the expected annual standard deviation of the portfolio? c.Briefly discuss the diversification effect by comparing the portfolio with individual stocks in terms of expected annual return and standard deviation. d. Briefly discuss which is a better measure of risk for a portfolio: beta cr standard deviation? e. Assume the portfolio has a beta of 1.5 and the expected return on the market portfolio for the coming year will be 10% and the risk-free rate will be 2%. Based on your answer to a), would you invest in this portfolio as per the CAPM? An investor has purchased 10,000 shares of Stock A at a price of $25 per share and 3,750 shares of Stock B at a price of $40 per share to form her portfolio. The characteristics of each of the stocks are summarized in the table below: Expected Expected Annual Annual Return Standard Deviation Stock A 14.4% 3.67% Stock B 9.8% 2.75% RAD=-0.4 Answer: a. What is the expected annual return of the portfolio? b. What is the expected annual standard deviation of the portfolio? c.Briefly discuss the diversification effect by comparing the portfolio with individual stocks in terms of expected annual return and standard deviation. d. Briefly discuss which is a better measure of risk for a portfolio: beta cr standard deviation? e. Assume the portfolio has a beta of 1.5 and the expected return on the market portfolio for the coming year will be 10% and the risk-free rate will be 2%. Based on your answer to a), would you invest in this portfolio as per the CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts