Question: Please show all steps & calculations (not just Excel formulas if used) Background: Amazon is attempting to buy PEPSI Amazon is offering 144.3 MM to

Please show all steps & calculations (not just Excel formulas if used)

Background:

- Amazon is attempting to buy PEPSI

- Amazon is offering 144.3 MM to buy PEPSI ; they are not buying a PEPSI bottling plant worth 40 MM however as part of the deal (please subtract this for final figures)

Please used the attached to find the following:

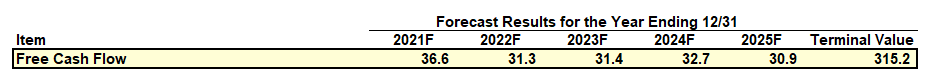

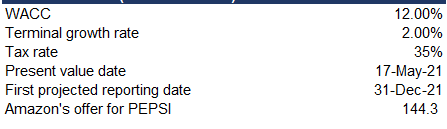

- Use a WACC of 12% to calculate Net Present Value of PEPSI's assets

- Take the present value of the cash flow totals shown, in addition to the terminal value noted and add them together.

- Subtract the bottling plant worth 40 MM.

***If anything is missing to assist, please let me know

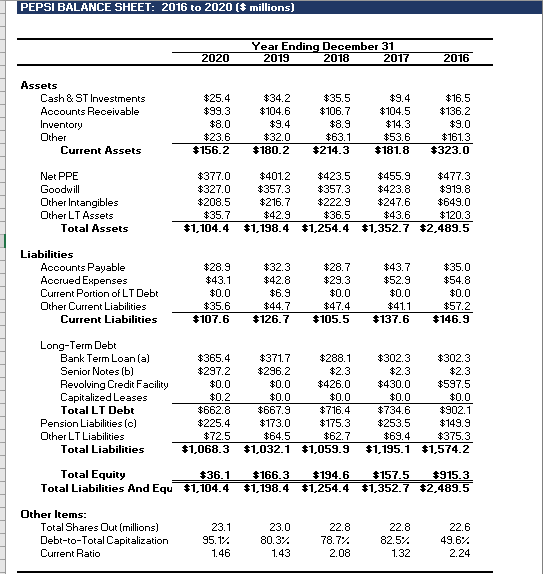

Forecast Results for the Year Ending 12/31 Item 2021F 2022F 2023F 2024F 2025F Terminal Value Free Cash Flow 36.6 31.3 31.4 32.7 30.9 315.2WACC 12.00% Terminal growth rate 2.00% Tax rate 35% Present value date 17-May-21 First projected reporting date 31-Dec-21 Amazon's offer for PEPSI 144.3PEPSI BALANCE SHEET: 2016 to 2020 ($ millions) Year Ending December 31 2020 2019 2018 2017 2016 Assets Cash & ST Investments $25.4 $34.2 $35.5 $9.4 $16.5 Accounts Receivable $93.3 $104.6 $106.7 $104.5 $136.2 Inventory $8.0 $9.4 $8.9 $14.3 $9.0 Other $23.6 $32.0 $63.1 $53.6 $161.3 Current Assets $156.2 $180.2 $214.3 $181.8 $323.0 Net PPE $377.0 $401.2 $423.5 $455.9 $477.3 Goodwill $327.0 $357.3 $357.3 $423.8 $919.8 Other Intangibles $208.5 $216.7 $222.9 $247.6 $649.0 Other LT Assets $35.7 142.9 $36.5 $43.6 $120.3 Total Assets $1,104.4 $1,198.4 $1,254.4 $1,352.7 $2.489.5 Liabilities Accounts Payable $28.9 $32.3 $28.7 $43.7 $35.0 Accrued Expenses $43.1 $42.8 $29.3 $52.9 $54.8 Current Portion of LT Debt $0.0 $6.9 $0.0 $0.0 $0.0 Other Current Liabilities $35.6 $44.7 $47.4 $41.1 $57.2 Current Liabilities $107.6 $126.7 $105.5 $137.6 $146.9 Long-Term Debt Bank Term Loan (a) $365.4 $371.7 $288.1 $302.3 $302.3 Senior Notes (b) $297.2 $296.2 $2.3 $2.3 $2.3 Revolving Credit Facility $0.0 $0.0 $426.0 $430.0 $597.5 Capitalized Leases $0.2 $0.0 $0.0 $0.0 $0.0 Total LT Debt $662.8 $667.9 $716.4 $734.6 $902.1 Pension Liabilities (c) $225.4 $173.0 $175.3 $253.5 $149.9 Other LT Liabilities $72.5 $64.5 $62.7 $69.4 $375.3 Total Liabilities $1,068.3 $1,032.1 $1,059.9 $1,195.1 $1,574.2 Total Equity $36.1 $166.3 $194.6 $157.5 $915.3 Total Liabilities And Equ $1,104.4 $1.198.4 $1,254.4 $1,352.7 $2,489.5 Other Items: Total Shares Out (millions) 23.1 23.0 22.8 22.8 22.6 Debt-to-Total Capitalization 95. 1% 80.3% 78.7% 82.5% 49.6% Current Ratio 1.46 1.43 2.08 1.32 2.24