Question: please show all steps for all problems - PS 32 - graded Due: Tuesday, April 19,2022, at 11:59:59 PM EDT | View List Unanswered y

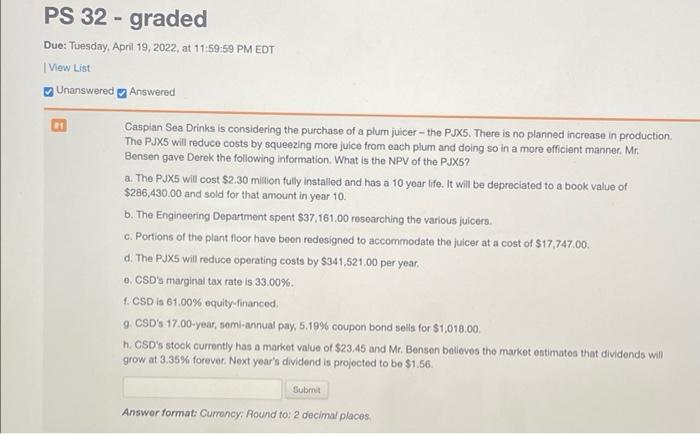

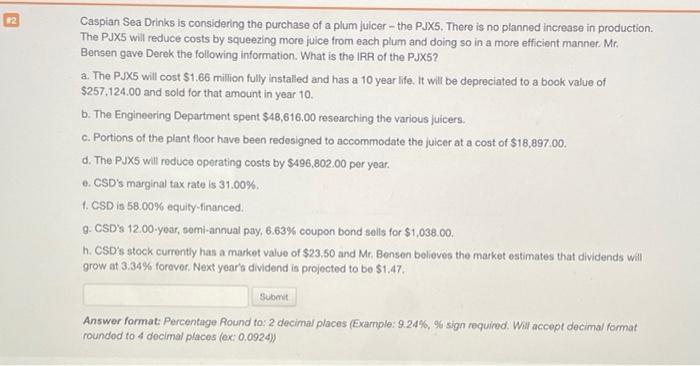

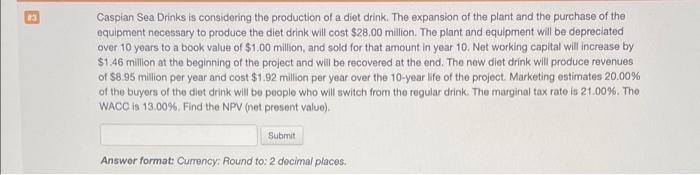

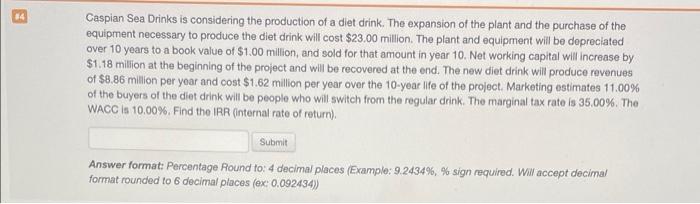

- PS 32 - graded Due: Tuesday, April 19,2022, at 11:59:59 PM EDT | View List Unanswered y Answered Caspian Sea Drinks is considering the purchase of a plum juicer - the PJX5. There is no planned increase in production The PJX5 will reduce costs by squeezing more juice from each plum and doing so in a more efficient manner. Mr. Bensen gave Derek the following information. What is the NPV of the PJX5? a. The PjX5 will cost $2.30 million tully installed and has a 10 year life. It will be depreciated to a book value of $286,430.00 and sold for that amount in year 10. b. The Engineering Department spent $37,161.00 researching the various juicers. c. Portions of the plant floor have been redesigned to accommodate the juicer at a cost of $17,747.00. d. The PJXS will reduce operating costs by $341,521,00 per year. o. CSD's marginal tax rate is 33,00% 1. CSD is 61.00% equity-financed, 9. CSD's 17.00-year, semi-annual pay, 5.19% coupon bond sells for $1,018.00 h. CSD's stock currently has a market value of $23.45 and Mr. Bensen believes the market ontimates that dividends will grow at 3,35% forever. Next year's dividend is projected to be $1.56. Submit Answer format: Currency: Round to: 2 decimal places #2 Caspian Sea Drinks is considering the purchase of a plum juicer - the PJX5. There is no planned increase in production The PJX5 will reduce costs by squeezing more juice from each plum and doing so in a more efficient manner. Mr. Benson gave Derek the following information. What is the IRR of the PJX5? a. The PJX5 will cost $1.66 million fully installed and has a 10 year life. It will be depreciated to a book value of $257,124.00 and sold for that amount in year 10. b. The Engineering Department spent $48,616.00 researching the various juicers. c. Portions of the plant floor have been redesigned to accommodate the juicer at a cost of $18,897.00. d. The PJXs will reduce operating costs by S496,802.00 per year. 0. CSD's marginal tax rate is 31.00% 1. CSD is 58.00% equity-financed. 9. CSD's 12.00-year, semi-annual pay, 6.63% coupon bond sells for $1,038.00. h. CSO's stock currently has a market value of $23,50 and Mr. Benson believes the market estimates that dividends will grow at 3,34% forever. Next year's dividend is projected to be $1.47. Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ox 0.0924) 3 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.46 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.95 million per year and cost $1.92 million per year over the 10-year life of the project Marketing estimates 20.00% of tho buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 21.00%. Tho WACC is 13.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places. 14 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $23.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.18 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.86 million per year and cost $1.62 million per year over the 10-year life of the project. Marketing estimates 11.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 35,00%. The WACC is 10.00%. Find the IRR (internal rate of return). Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts