Question: please show all steps in the calculation The current value of a security is 16 million euro. Compute the expected return and volatility, both in

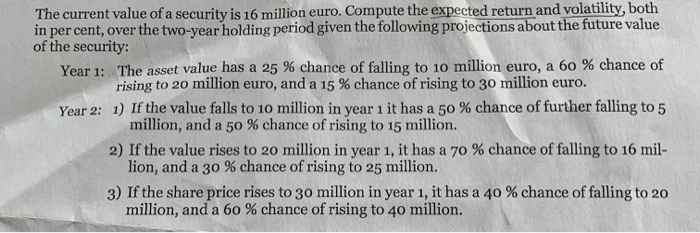

The current value of a security is 16 million euro. Compute the expected return and volatility, both in per cent over the two-year holding period given the following projections about the future value of the security: Year 1: The asset value has a 25 % chance of falling to 10 million euro, a 60 % chance of rising to 20 million euro, and a 15 % chance of rising to 30 million euro. Year 2: 1) If the value falls to 10 million in year 1 it has a 50 % chance of further falling to 5 million, and a 50 % chance of rising to 15 million. 2) If the value rises to 20 million in year 1, it has a 70 % chance of falling to 16 mil- lion, and a 30 % chance of rising to 25 million. 3) If the share price rises to 30 million in year 1, it has a 40 % chance of falling to 20 million, and a 60 % chance of rising to 40 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts