Question: please show all steps, including the formulas. You have been asked to evaluate two mutually exclusive earth moving pieces of equipment used during the construction

please show all steps, including the formulas.

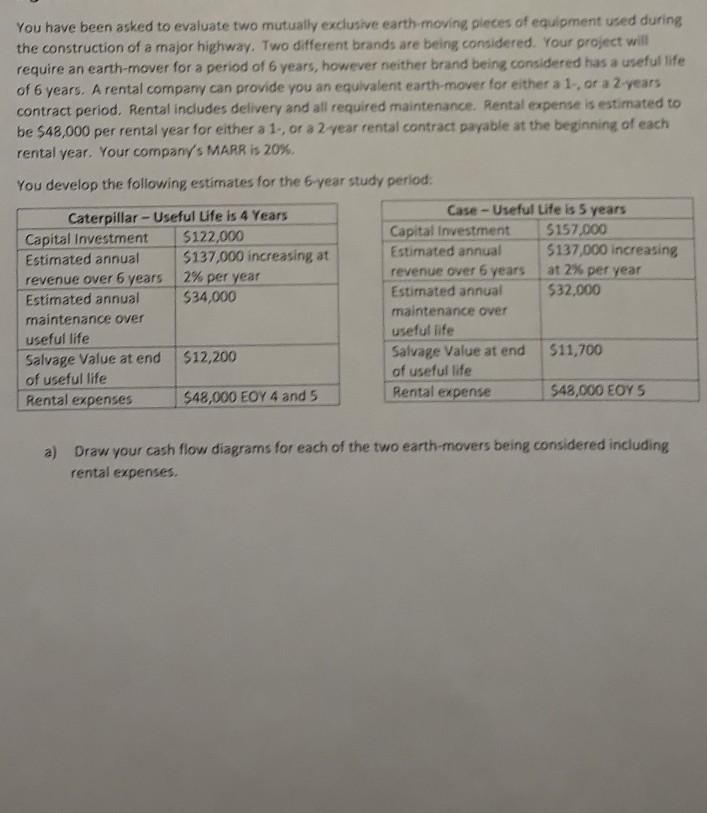

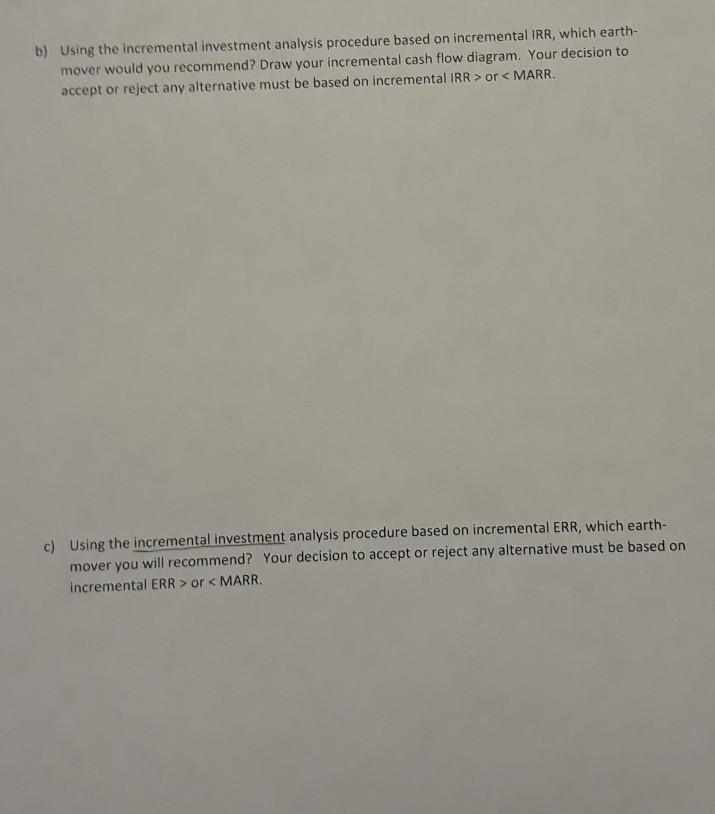

You have been asked to evaluate two mutually exclusive earth moving pieces of equipment used during the construction of a major highway. Two different brands are being considered. Your project will require an earth-mover for a period of 6 years, however neither brand being considered has a useful life of 6 years. A rental company can provide you an equivalent earth mover for either a 1-, or a 2 years contract period. Rental includes delivery and all required maintenance. Rental expense is estimated to be $48,000 per rental year for either a 1., or a 2 year rental contract payable at the beginning of each rental year. Your company's MARR is 20% You develop the following estimates for the 6 year study period: Caterpillar - Useful Life is 4 Years Case - Useful Life is 5 years Capital Investment $122,000 Capital Investment $157,000 Estimated annual $137,000 increasing at Estimated annual $137,000 increasing revenue over 6 years 2% per year revenue over 6 years at 2% per year Estimated annual $34,000 Estimated annual $32,000 maintenance over maintenance over useful life useful life Salvage Value at end $12,200 Salvage Value at end 511,700 of useful life of useful life Rental expenses $48,000 EOY 4 and 5 Rental expense $48,000 EOY 5 a) Draw your cash flow diagrams for each of the two earth-movers being considered including rental expenses. b) Using the incremental investment analysis procedure based on incremental IRR, which earth- mover would you recommend? Draw your incremental cash flow diagram. Your decision to accept or reject any alternative must be based on incremental IRR> or

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts