Question: please show all the calculation and formula used. a) b) c) Tq (a) The following represents the information for two stocks, Al and B2 :

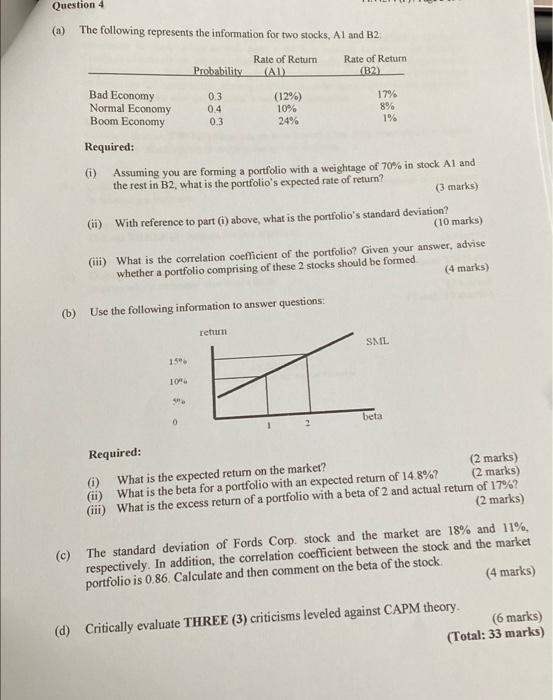

(a) The following represents the information for two stocks, Al and B2 : Required: (i) Assuming you are forming a portfolio with a weightage of 70% in stock A1 and: the rest in B2, what is the portfolio's expected rate of retum? (3 marks) (ii) With reference to part (i) above, what is the portfolio's standard deviation? (10 marks) (iii) What is the correlation coefficient of the portfolio? Given your answer, advise whether a portfolio comprising of these 2 stocks should be formed (4 marks) (b) Use the following information to answer questions: Required: (i) What is the expected retum on the market? (2 marks) (ii) What is the beta for a portfolio with an expected return of 14.8% ? (2 marks) (iii) What is the excess return of a portfolio with a beta of 2 and actual return of 17% ? (2 marks) (c) The standard deviation of Fords Corp. stock and the market are 18% and 11%, respectively. In addition, the correlation coefficient between the stock and the market portfolio is 0.86. Calculate and then comment on the beta of the stock. (4 marks) (d) Critically evaluate THREE (3) criticisms leveled against CAPM theory. (6 marks) (Total: 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts