Question: Please show all the calculation.. Use the template below with the following assumptions to determine the enterprise value of this company in today's dollars. Cash

Please show all the calculation..

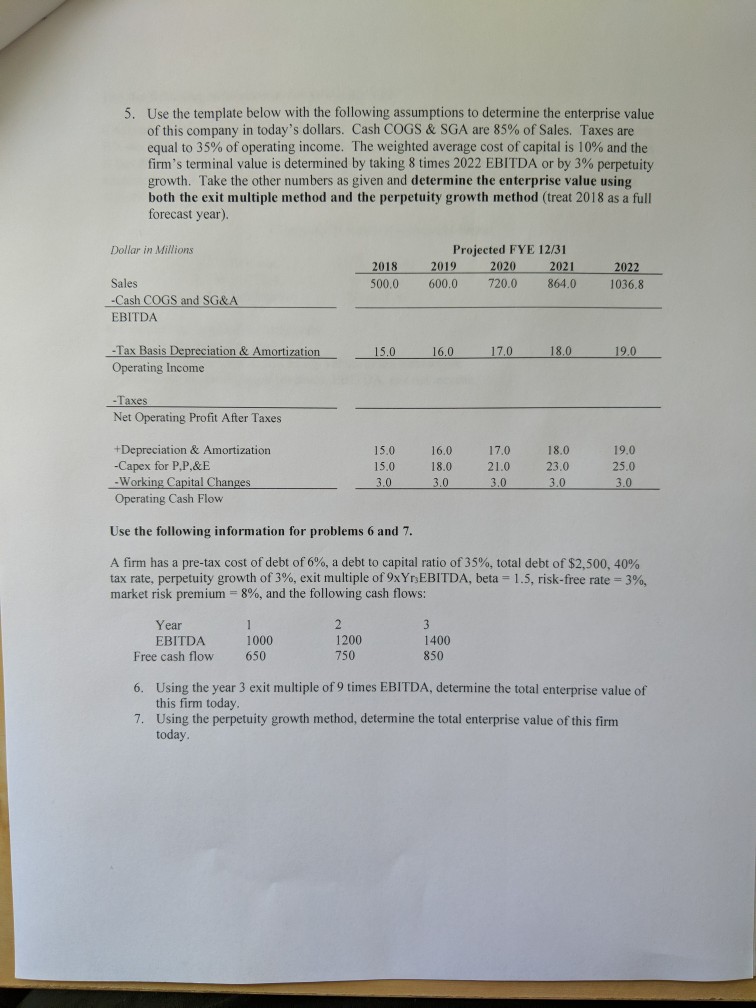

Use the template below with the following assumptions to determine the enterprise value of this company in today's dollars. Cash COGS & SGA are 85% of Sales. Taxes are equal to 35% of operating income. The weighted average cost of capital is 10% and the firm's terminal value is determined by taking 8 times 2022 EBITDA or by 3% perpetuity growth. Take the other numbers as given and determine the enterprise value using both the exit multiple method and the perpetuity growth method (treat 2018 as a full forecast year). 5. Projected FYE 12/31 2020 500.0 600.0 720.0 864.0 1036.8 Dollar in Millions Sales EBITDA -Tax Basis Depreciation & Amortization15.0 2018 2019 2021 2022 -Cash COGS and SG&A 16.0 17.0 18.0 9.0 Operating Income Net Operating Profit After Taxes +Depreciation & Amortization -Capex for P.P.&E Working Capital Changes Operating Cash Flow 15.0 16.0 17.0 18.0 19.0 15.0 18.0 21.0 23.0 3.0 3.0 3.0 3.0 3.0 Use the following information for problems 6 and 7. A firm has a pre-tax cost of debt of 6%, a debt to capital ratio of 35%, total debt of $2 500.40% tax rate, perpetuity growth of 3%, exit multiple of 9xYnEBITDA, bet-1.5, risk-free rate 3%, market risk premium-8%, and the following cash flows: Year EBITDA 1000 650 1200 750 1400 850 Free cash flow 6. 7. Using the year 3 exit multiple of 9 times EBITDA, determine the total enterprise value of this firm today Using the perpetuity growth method, determine the total enterprise value of this firm today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts