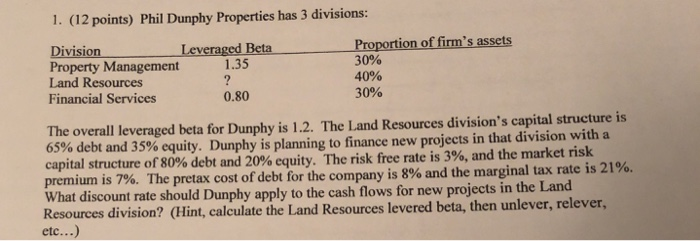

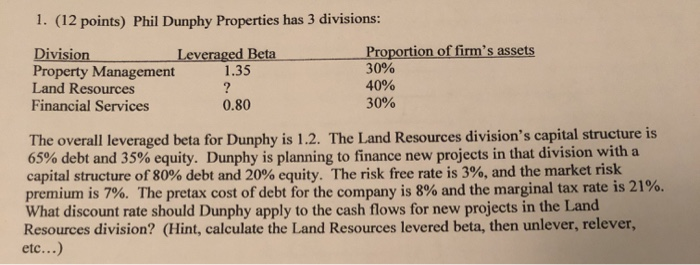

Question: please show all work! 1. (12 points) Phil Dunphy Properties has 3 divisions: Division Leveraged Beta Property Management 1.35 Land Resources Financial Services 0.80 Proportion

1. (12 points) Phil Dunphy Properties has 3 divisions: Division Leveraged Beta Property Management 1.35 Land Resources Financial Services 0.80 Proportion of firm's assets 30% 40% 30% The overall leveraged beta for Dunphy is 1.2. The Land Resources division's capital structure is 65% debt and 35% equity. Dunphy is planning to finance new projects in that division with a capital structure of 80% debt and 20% equity. The risk free rate is 3%, and the market risk premium is 7%. The pretax cost of debt for the company is 8% and the marginal tax rate is 21%. What discount rate should Dunphy apply to the cash flows for new projects in the Land Resources division? (Hint, calculate the Land Resources levered beta, then unlever, relever, etc...) 1. (12 points) Phil Dunphy Properties has 3 divisions: Division Leveraged Beta Property Management 1.35 Land Resources Financial Services 0.80 Proportion of firm's assets 30% 40% 30% The overall leveraged beta for Dunphy is 1.2. The Land Resources division's capital structure is 65% debt and 35% equity. Dunphy is planning to finance new projects in that division with a capital structure of 80% debt and 20% equity. The risk free rate is 3%, and the market risk premium is 7%. The pretax cost of debt for the company is 8% and the marginal tax rate is 21%. What discount rate should Dunphy apply to the cash flows for new projects in the Land Resources division? (Hint, calculate the Land Resources levered beta, then unlever, relever, etc...)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts