Question: Please show all work 1. Mankins Incorporated is considering using units of an old raw material in a special project. The special project would require

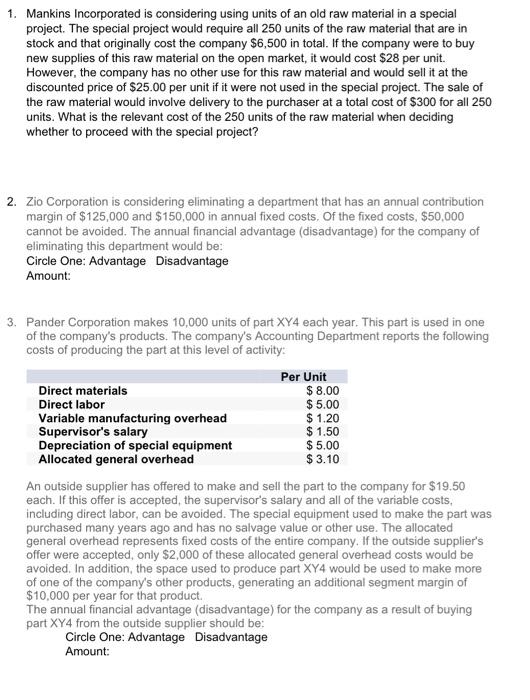

1. Mankins Incorporated is considering using units of an old raw material in a special project. The special project would require all 250 units of the raw material that are in stock and that originally cost the company $6,500 in total. If the company were to buy new supplies of this raw material on the open market, it would cost $28 per unit. However, the company has no other use for this raw material and would sell it at the discounted price of $25.00 per unit if it were not used in the special project. The sale of the raw material would involve delivery to the purchaser at a total cost of $300 for all 250 units. What is the relevant cost of the 250 units of the raw material when deciding whether to proceed with the special project? 2. Zio Corporation is considering eliminating a department that has an annual contribution margin of $125,000 and $150,000 in annual fixed costs. Of the fixed costs, $50,000 cannot be avoided. The annual financial advantage (disadvantage) for the company of eliminating this department would be: Circle One: Advantage Disadvantage Amount: 3. Pander Corporation makes 10,000 units of part XY4 each year. This part is used in one of the company's products. The company's Accounting Department reports the following costs of producing the part at this level of activity: An outside supplier has offered to make and sell the part to the company for $19.50 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $2,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce part XY4 would be used to make more of one of the company's other products, generating an additional segment margin of $10,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part XY4 from the outside supplier should be: Circle One: Advantage Disadvantage Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts