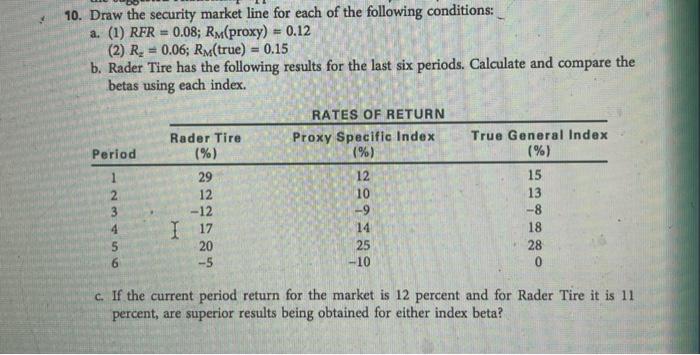

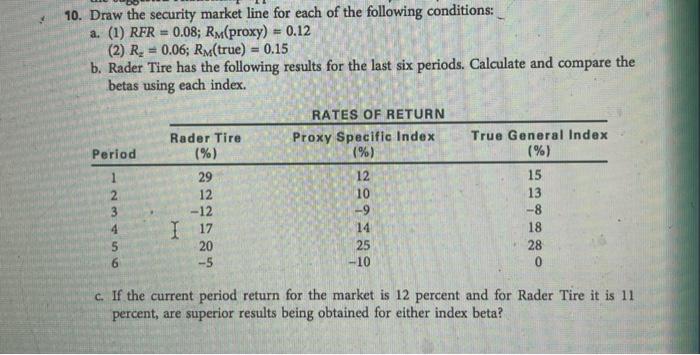

Question: please show all work 10. Draw the security market line for each of the following conditions: a. (1) RFR = 0.08; Rm(proxy) 0.12 (2) R

please show all work

10. Draw the security market line for each of the following conditions: a. (1) RFR = 0.08; Rm(proxy) 0.12 (2) R = 0.06; Rm(true) = 0.15 b. Rader Tire has the following results for the last six periods. Calculate and compare the betas using each index. True General Index (%) Period 1 2 3 4 5 6 Rader Tire (%) 29 12 -12 I 17 20 -5 RATES OF RETURN Proxy Specific Index (%) 12 10 -9 14 25 -10 15 13 -8 18 28 0 c. If the current period return for the market is 12 percent and for Rader Tire it is 11 percent, are superior results being obtained for either index beta

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock