Question: Please show all work!!! A mutual fund manager has a $30 million portfolio with a beta of 1.00. The risk-free rate is 4.25%, and the

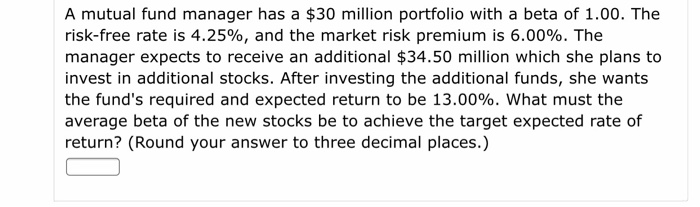

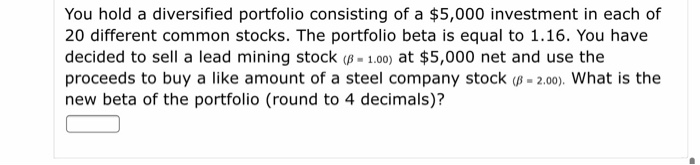

A mutual fund manager has a $30 million portfolio with a beta of 1.00. The risk-free rate is 4.25%, and the market risk premium is 6.00%. The manager expects to receive an additional $34.50 million which she plans to invest in additional stocks. After investing the additional funds, she wants the fund's required and expected return to be 13.00%. What must the average beta of the new stocks be to achieve the target expected rate of return? (Round your answer to three decimal places.) You hold a diversified portfolio consisting of a $5,000 investment in each of 20 different common stocks. The portfolio beta is equal to 1.16. You have decided to sell a lead mining stock ( - 1.00) at $5,000 net and use the proceeds to buy a like amount of a steel company stock (-2.00). What is the new beta of the portfolio (round to 4 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts