Question: Please show all work and calculations please dont use pv fv or any other financial calculations please only math and in excel 7. Replicate in

Please show all work and calculations please dont use pv fv or any other financial calculations please only math and in excel

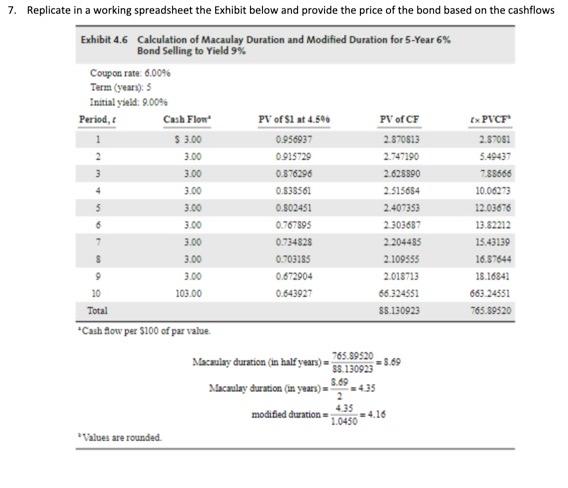

7. Replicate in a working spreadsheet the Exhibit below and provide the price of the bond based on the cashflows Exhibit 4.6 Calculation of Macaulay Duration and Modified Duration for 5-Year 6% Bond Selling to Yield 9% Coupon rate: 6.00% Term (years), Initialysed: 9.00% Period, Cash Flow PV of 1 at 4.596 PV of CF Ex PVC $ 3.00 0.956937 2.870613 2.87051 3.00 0.915729 2.747190 5.49433 3 3.00 0.876296 2.625590 288666 3.00 0.538561 2515654 10.06273 3.00 0.802451 2.407353 12.03676 3.00 0.767895 2 303687 13.82212 3.00 0.734828 2 204485 15.43139 3.00 0.703185 2.109355 16.37644 9 3.00 0.672904 2.018713 18.16841 30 103.00 0.643927 66.324551 663.24551 Total 88.130923 765.89520 *Cash Bow per $100 of par value 4 5 Macaulay duration (in half years) = 765.89520 =.69 $8.130923 3.69 Macaulay duration (in years) = 4.35 2 4.35 modified duration - =4.16 1.0450 *Values are rounded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts