Question: Please show all work and clear steps as to how you got each solution!! Suppose you invest $20,000 by purchasing 200 shares of Abbott Labs

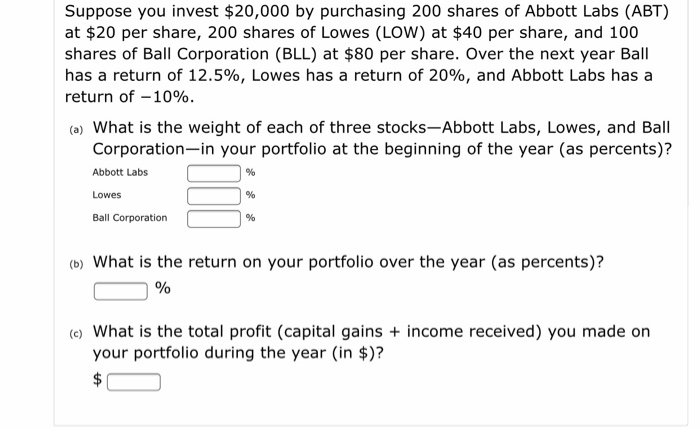

Suppose you invest $20,000 by purchasing 200 shares of Abbott Labs (ABT) at $20 per share, 200 shares of Lowes (LOW) at $40 per share, and 100 shares of Ball Corporation (BLL) at $80 per share. Over the next year Ball has a return of 12.5%, Lowes has a return of 20%, and Abbott Labs has a return of -10%. (a) What is the weight of each of three stocks-Abbott Labs, Lowes, and Ball Corporation in your portfolio at the beginning of the year (as percents)? Abbott Labs Lowes Ball Corporation (b) What is the return on your portfolio over the year (as percents)? % (c) What is the total profit (capital gains + income received) you made on your portfolio during the year (in $)? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts