Question: please show all work and equations 3. (27 pts) (NOTE: You do not need a cash flow diagram for this problem.) The following financial information

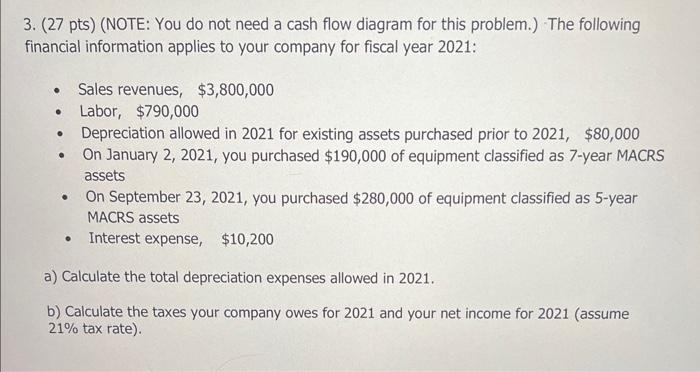

3. (27 pts) (NOTE: You do not need a cash flow diagram for this problem.) The following financial information applies to your company for fiscal year 2021: - Sales revenues, $3,800,000 - Labor, $790,000 - Depreciation allowed in 2021 for existing assets purchased prior to 2021,$80,000 - On January 2, 2021, you purchased $190,000 of equipment classified as 7-year MACRS assets - On September 23, 2021, you purchased $280,000 of equipment classified as 5-year MACRS assets - Interest expense, $10,200 a) Calculate the total depreciation expenses allowed in 2021. b) Calculate the taxes your company owes for 2021 and your net income for 2021 (assume 21% tax rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts