Question: Please show all work and equations used. For part B: When you calculate the expected one day IPO return on your investments, the weight on

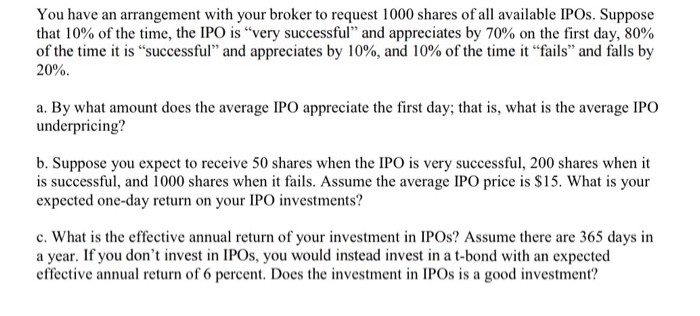

You have an arrangement with your broker to request 1000 shares of all available IPOs. Suppose that 10% of the time, the IPO is "very successful" and appreciates by 70% on the first day, 80% of the time it is "successful" and appreciates by 10%, and 10% of the time it "fails" and falls by 20% a. By what amount does the average IPO appreciate the first day; that is, what is the average IPO underpricing? b. Suppose you expect to receive 50 shares when the IPO is very successful, 200 shares when it is successful, and 1000 shares when it fails. Assume the average IPO price is $15. What is your expected one-day return on your IPO investments? c. What is the effective annual return of your investment in IPOs? Assume there are 365 days in a year. If you don't invest in IPOs, you would instead invest in a t-bond with an expected effective annual return of 6 percent. Does the investment in IPOs is a good investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts