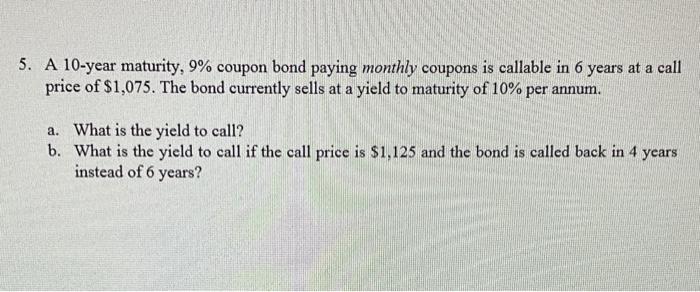

Question: Please show all work and explain each step (and formulas used). Do not use Excel 5. A 10 -year maturity, 9% coupon bond paying monthly

5. A 10 -year maturity, 9% coupon bond paying monthly coupons is callable in 6 years at a call price of $1,075. The bond currently sells at a yield to maturity of 10% per annum. a. What is the yield to call? b. What is the yield to call if the call price is $1,125 and the bond is called back in 4 years instead of 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts