Question: Please show all work and explain each step (and each formulas used). Do NOT use Excel. A bond with a 10% coupon paid semiannually every

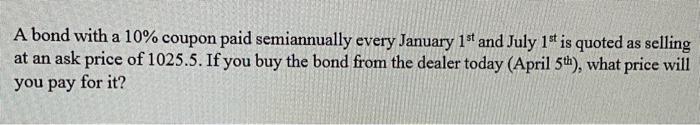

A bond with a 10% coupon paid semiannually every January 1st and July 1st is quoted as selling at an ask price of 1025.5 . If you buy the bond from the dealer today (April 5th ), what price will you pay for it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts