Question: PLEASE SHOW ALL WORK AND FORMULAS. DON'T USE EXCEL. I posted this question and although the answer is correct when I put those numbers into

PLEASE SHOW ALL WORK AND FORMULAS. DON'T USE EXCEL.

PLEASE SHOW ALL WORK AND FORMULAS. DON'T USE EXCEL.

I posted this question and although the answer is correct when I put those numbers into my calculator I can't find that answer. Can someone please solve this again.

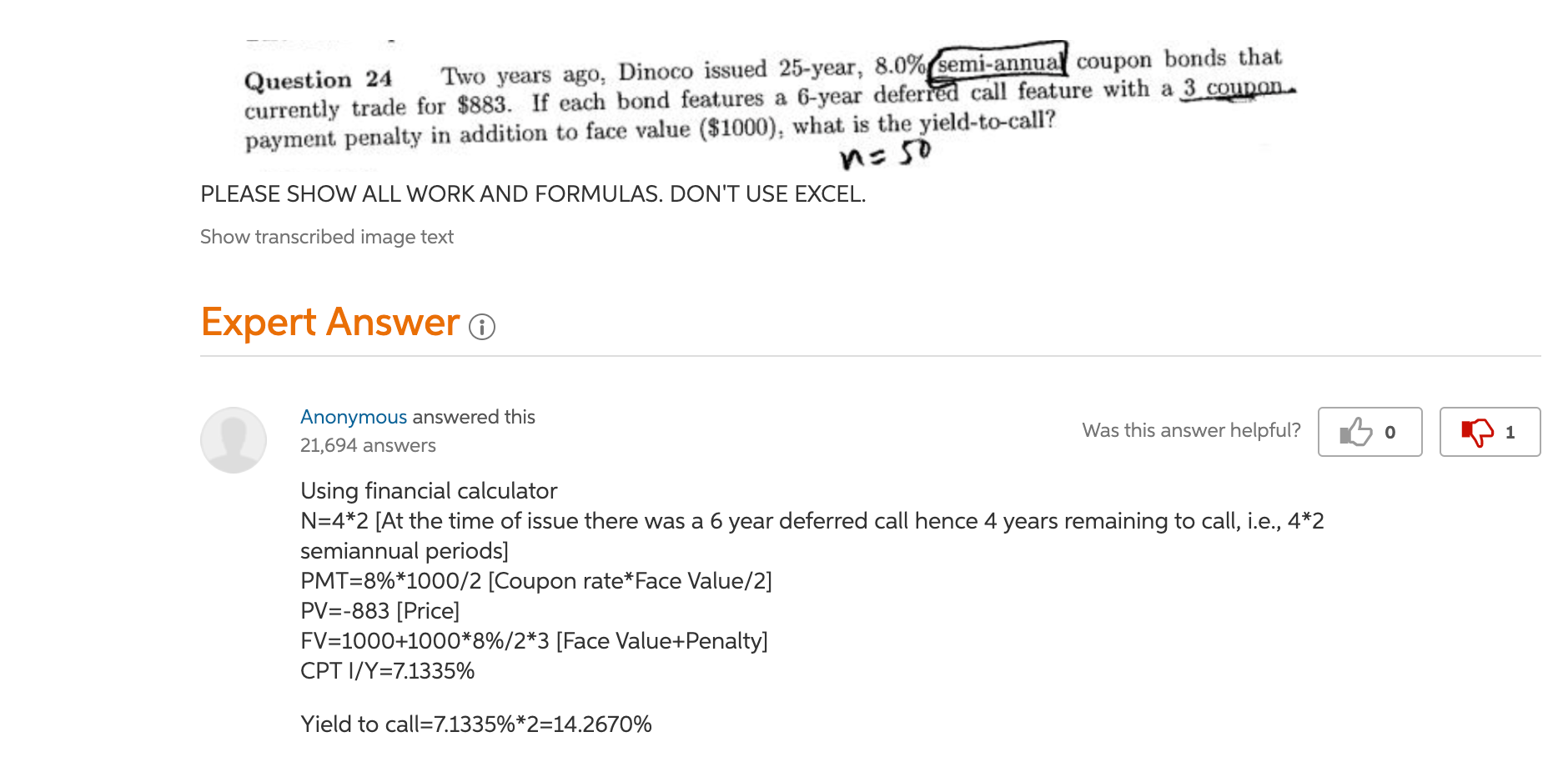

Question 24 Two years ago, Dinoco issued 25-year, 8.0% semi-annual coupon bonds that currently trade for $883. If each bond features a 6-year deferred call feature with a 3 coupon. payment penalty in addition to face value ($1000), what is the yield-to-call? na 50 PLEASE SHOW ALL WORK AND FORMULAS. DON'T USE EXCEL. Show transcribed image text Expert Answer o Anonymous answered this 21,694 answers Was this answer helpful? Bo 1 Using financial calculator N=4*2 [At the time of issue there was a 6 year deferred call hence 4 years remaining to call, i.e., 4*2 semiannual periods] PMT=8%*1000/2 [Coupon rate* Face Value/2] PV=-883 [Price] FV=1000+1000*8%/2*3 [Face Value+Penalty] CPT I/Y=7.1335% Yield to call=7.1335%*2=14.2670%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts