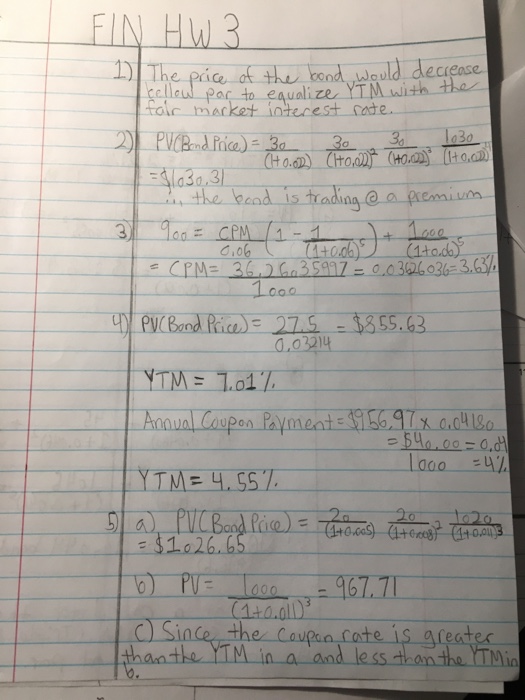

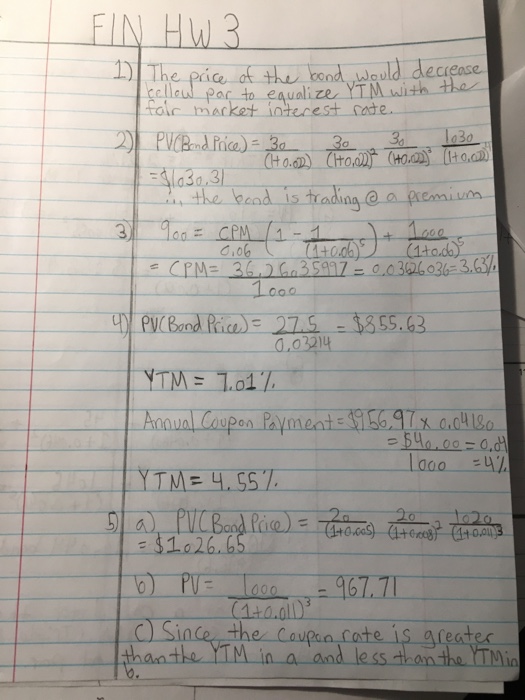

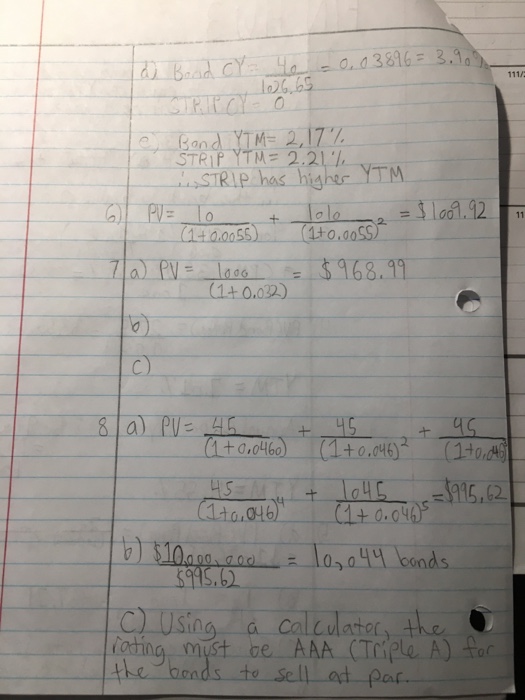

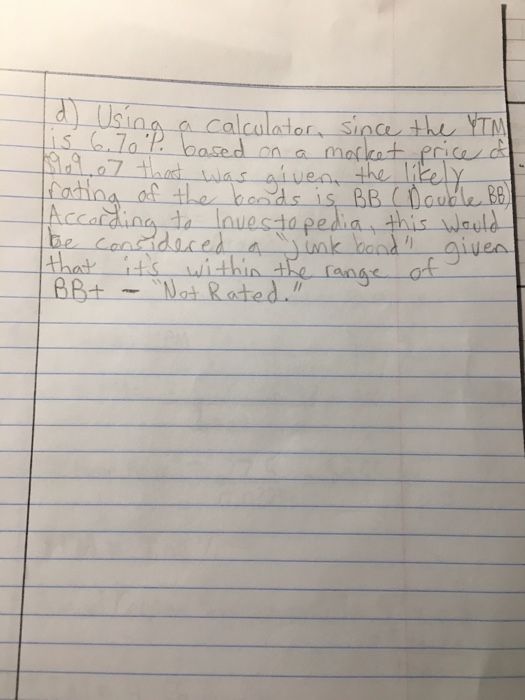

Question: Hello, If you could check my work starting from question 5 a), that would be greatly appreciated. Additionally, please make sure to show your work

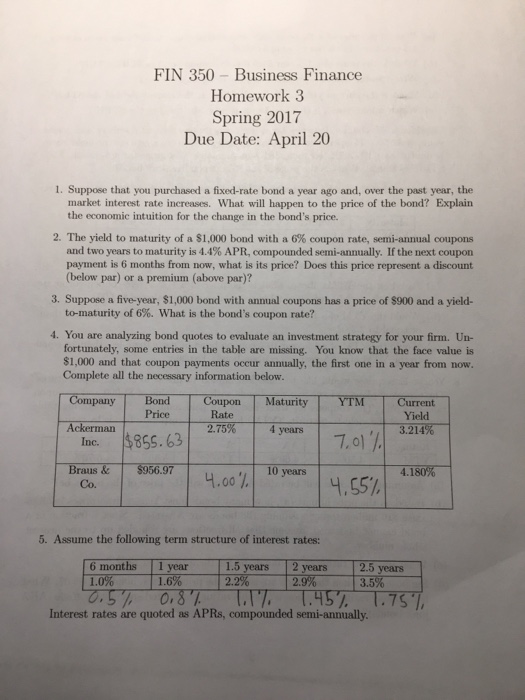

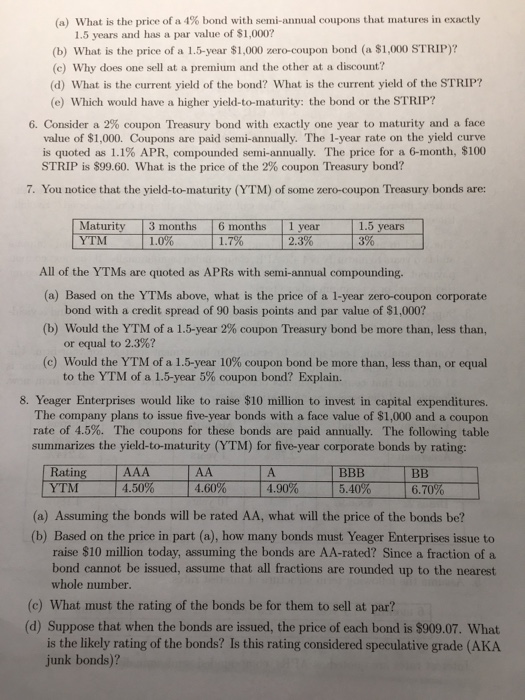

FIN 350 Business Finance Homework 3 Spring 2017 Due Date: April 20 1. Suppose that you purchased a fixed-rate bond a year ago and, over the past year, the market interest rate increases. What will happen to the price of the bond? Explain the economic intuition for the change in the bond's price. 2. The yield to maturity of a si,000 bond with a 6% coupon rate, semi-annual coupons and two years to maturity is 4.4% APR, compounded semi-annually. If the next coupon payment is 6 months from now, what is its price? Does this price represent a discount (below par) or a premium (above par)? 3. Suppose a five-year, $1,000 bond with annual coupons has a price of s900 and a yield- to maturity of 6%. What is the bond's coupon rate? 4. You are analyzing bond quotes to evaaluate an investment strategy for your firm. Un- fortunately, some entries in the table are missing. You know that the face value is $1,000 and that coupon payments occur annually, the first one in a year from now. Complete all the necessary information below. Company T Bond Coupon T Maturity YTM Current Yield Ackerman 2.75% 4 years 3.214% Inc. 855.63 Braus & $956.97 10 years Co. 5. Assume the following term structure of interest rates: 6 months 1 year 1.5 years 2 years T2.5 years 1.0% 1.6% 12.2% 29% 3.5% Interest rates are quoted as APRs, compounded semi-annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts